Real-time signals, professional portfolio analytics, and exclusive insights – all powered by our deflationary token engineered for increasing value.

FOLO is designed to appreciate as our ecosystem grows.

FOLO initial

total supply

Next scheduled

burn

Current FOLO

deflationary supply

Our token value is built on two immutable principles: supply can only decrease, and no new FOLO tokens will ever be minted.

While our distribution schedule permits wider release, we’ve strategically limited circulation to less than 20% of eligible tokens as of January 2025. This limitation creates natural market scarcity, creating more value through fundamental supply dynamics.

Discover how we’ve engineered scarcity into every aspect of FOLO – from our strategic burn schedule to our controlled distribution model.

Each month, we permanently remove millions of FOLO tokens from circulation through our smart contract burn function. It’s simple math: fewer tokens in circulation means each remaining FOLO represents a bigger piece of our ecosystem.

Every burn is announced on Alpha Impact with Etherscan verification links, so you can watch our supply shrink in real-time.

Understand how FOLO works in just three steps.

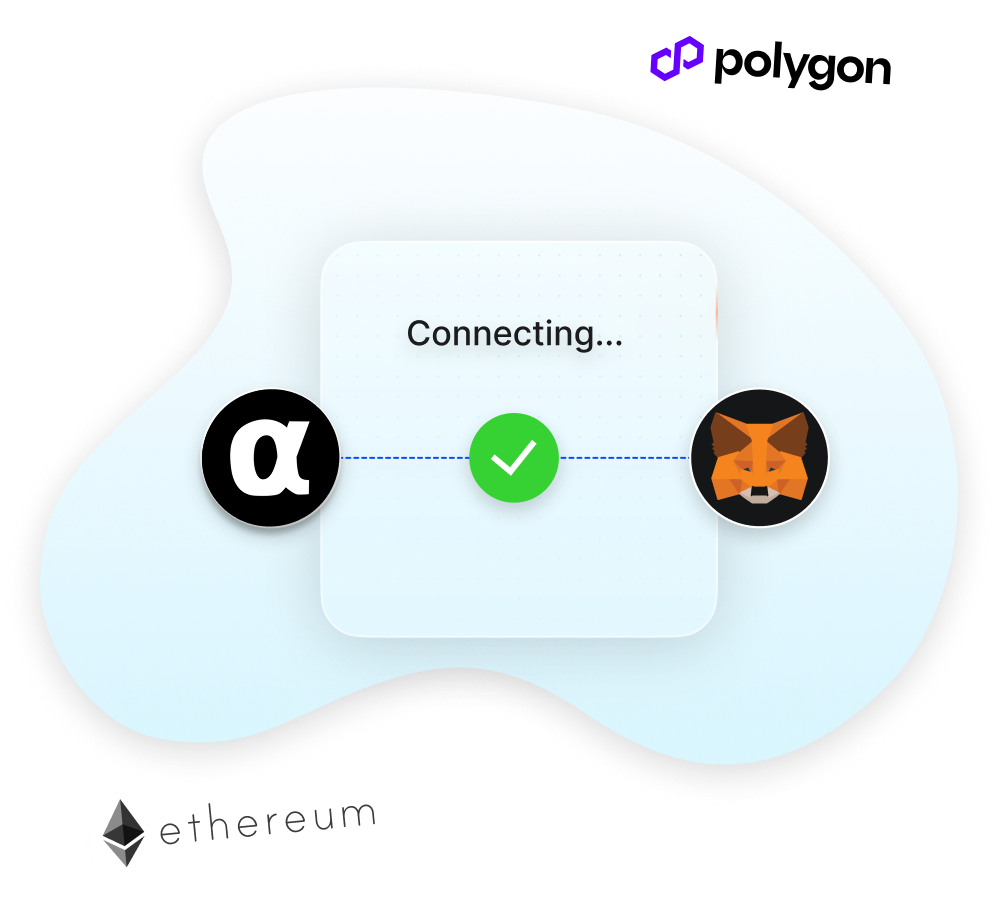

Swap your digital assets for FOLO through MetaMask, a secure on-chain wallet.

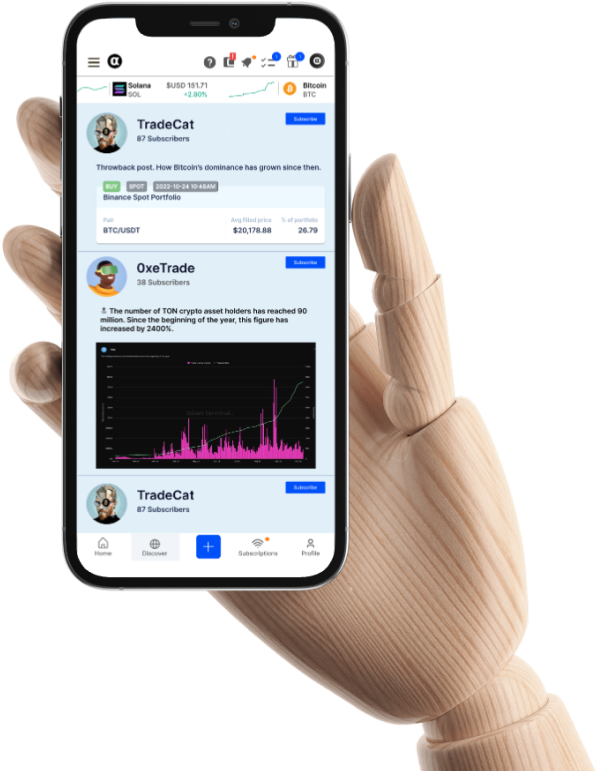

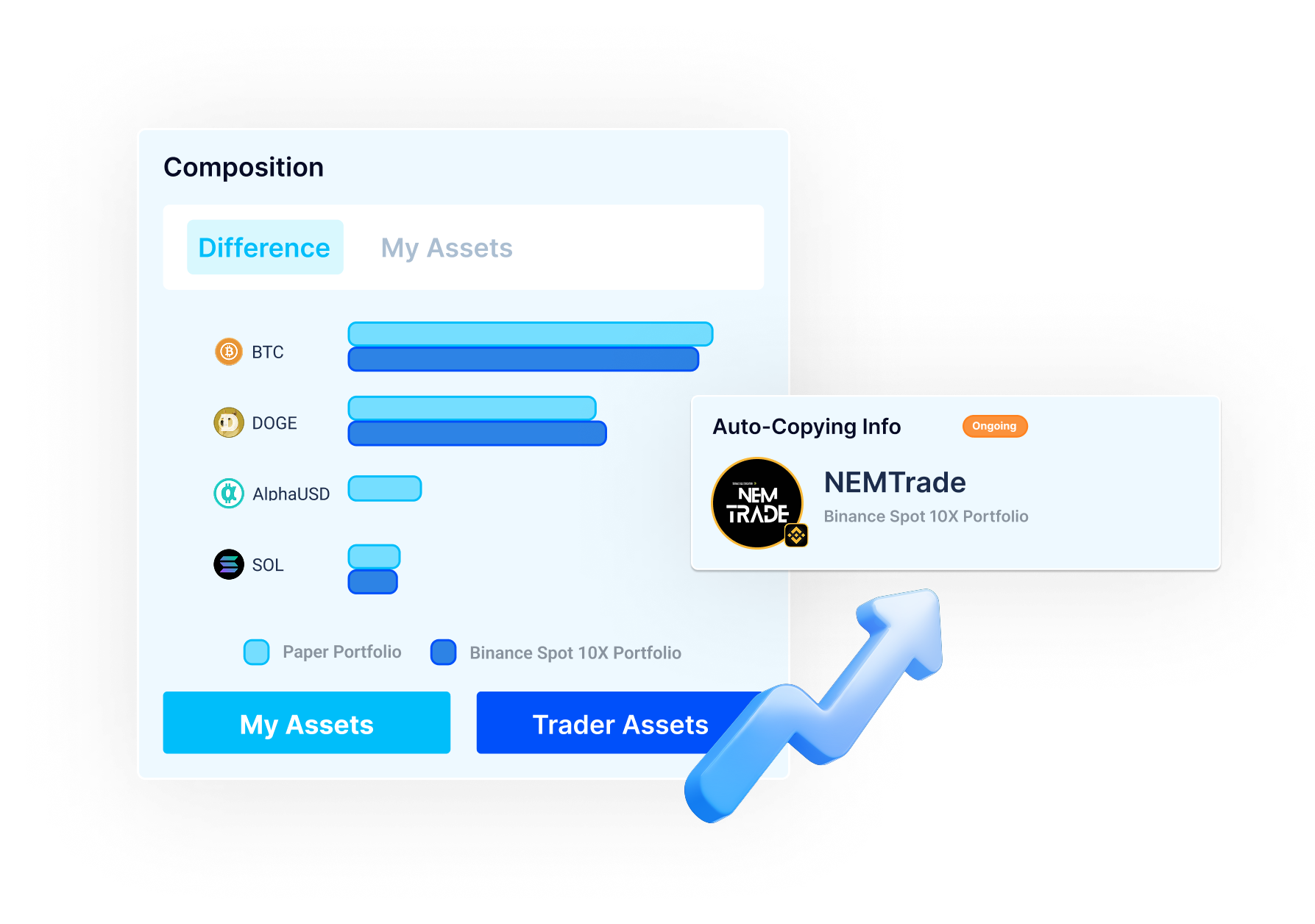

Use FOLO to subscribe to lead traders, receive real-time trading signals, and access exclusive insights

Accumulate free FOLO Points through platform participation, convertible to token value* (T&C Apply)

Choose the method that works best for you:

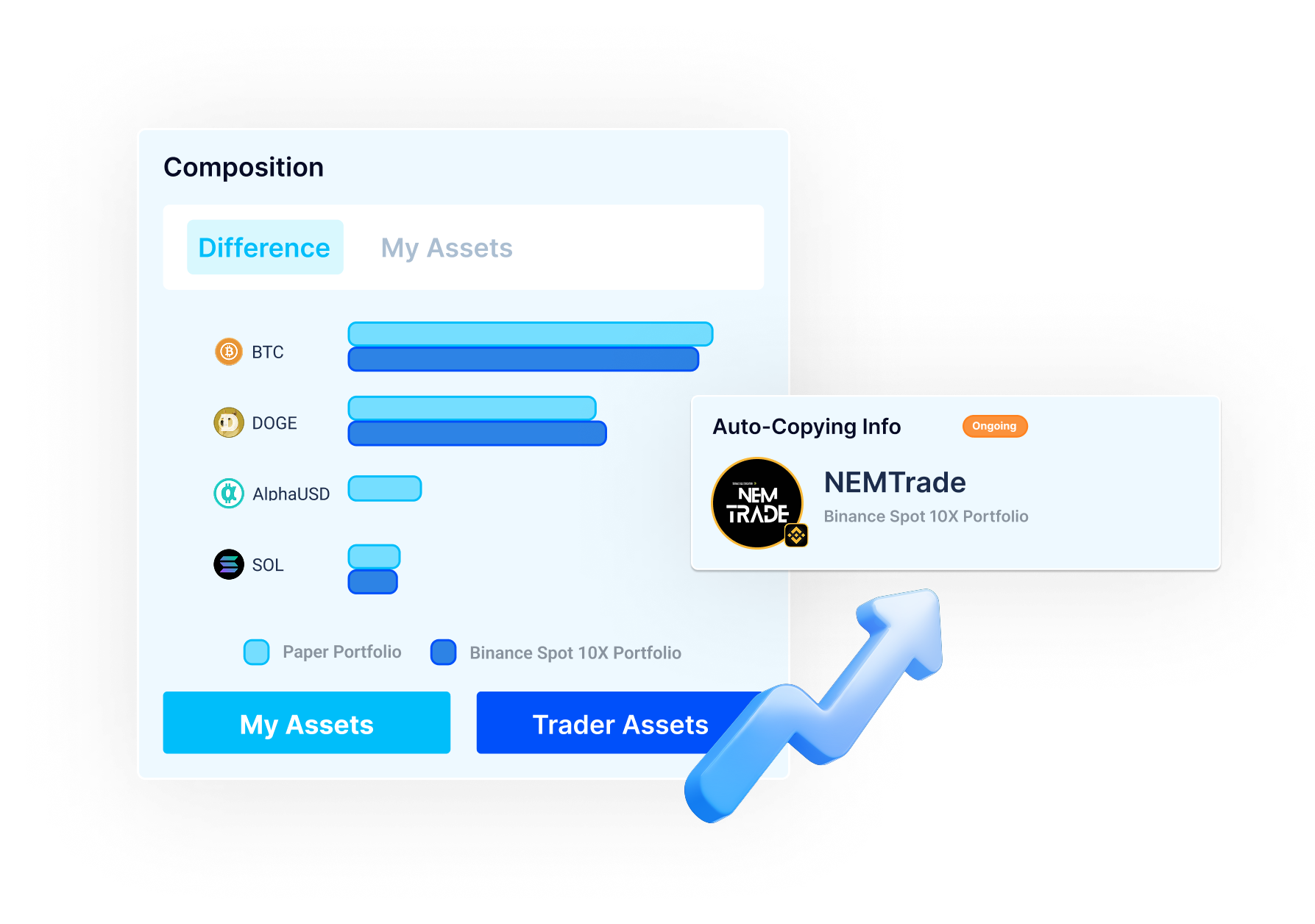

Deposit FOLO seamlessly into your Alpha Impact wallet via either Ethereum (ETH) or Polygon (POL) networks.

Turn platform activity into valuable rewards. From profile setup to community engagement, every step counts!

With FOLO Points, you can:

Convert your trade signals into passive income with us! Set your own price in FOLO or USDT and earn monthly revenue.

Submit a question and check out our Help Desk here.

Still have questions? Our support team is here to assist you!

It only takes three minutes to link your portfolio with us.