How Do I Buy Cryptocurrency?

According to Statista the number of global cryptocurrency users crossed the 100 million mark earlier in 2021 and shows no sign of slowing down! Given the significant number of financial providers recently integrating with cryptos such as Paypal, Visa, and various banks, the once-maligned bitcoin is now being embraced by the average person on the street as an alternative to traditional finance.

If you are new to crypto it can be quite overwhelming to understand how to get on board and what companies you can trust in the space. Thankfully the ecosystem has matured a lot in the last few years and it is much easier to buy, store and generate income from your cryptocurrency than in the past. Despite this, it is still important to exercise caution and do some of your own reading to understand the various products and services in more detail before hitting the buy button!

BASIC GUIDE TO CRYPTO ONBOARDING

At a high level, there are a few things to consider when embarking upon your first jump into buying crypto;

- Exchanges

- Placing Buy Orders

- Wallets

- Generating Yield

Exchanges

- In order to buy crypto, you currently need to register an account with specialist cryptocurrency exchanges and onramps. Depending on the country you are in, there may be some specialist local options, however, Alpha Impact can recommend our global partners such as Binance and FTX. In both cases, you can transfer fiat currency (another term for traditional cash) via bank transfer after some initial customer onboarding requirements to prove your identity. You can also buy crypto via credit card with Binance yet you will pay more in fees and this may not be available in some jurisdictions. FTX also accepts deposits via Paypal.

Placing Buy Orders

- Depending on the exchange you use, you will generally have two different ways of executing a “buy” (and sell) order. Unless it is clearly stated otherwise, you will likely be purchasing via a “market” order where you will be effectively taking whatever the market price is at that point in time. As cryptocurrencies can be quite volatile, placing a market order is almost certainly not going to be the best price. Alternatively, if you execute a “limit” order, you can determine what price you wish to pay (eg; you define your price limit rather than the platform buying on your behalf). If you don’t see the ability to place a limit order when you buy your crypto, you should check to see if the platform has that functionality, otherwise, it is likely you are paying a higher rate for this transaction and could be losing the opportunity to have even more crypto! However, if you are a long-term “buy and hold” type investor, some of these movements are less likely to be of concern to you.

Wallets

- Once you’ve purchased your crypto, you should take some off the exchange and into an external wallet for safekeeping. With the balance of your funds, you will want to leave it on the exchange for trading (including Alpha Impact copy trading!). The reason for doing this is to safeguard your crypto in the event that the exchange gets hacked or has some other restriction that means you are blocked from accessing your funds. In this case, you are effectively your own bank. In terms of wallets, you can choose from dozens of options which include hardware and software (web, mobile, and desktop) versions. Arguably the most secure of all of these options is the hardware wallet and popular companies in this space include Trezor and Ledger. Once you purchase a hardware wallet you can connect it to your computer via USB and transfer funds using your private keys. It is worth noting that if you intend on trading particular types of cryptocurrencies or using some DeFi yield farming strategies, some projects may require you to use a web wallet such as MetaMask.

Generating Yield

- While we discussed the safest strategy for your crypto is to store it on an external wallet, there are a number of strategies you can take to create additional yield from your asset just like in the traditional banking space. These strategies include;

- Lending: providing your assets for others to borrow in exchange for a rate of interest in return via platforms such as Hodlnaut and BlockFi

- Staking: some projects such as Ethereum provide yield when you ‘stake’ or lock up your tokens to strengthen the stability of the network

- Yield Farming: This strategy is not for newbies as it can get quite complicated, however, the returns can be very lucrative especially compared to traditional banking yields. In a nutshell, yield farming is where you provide your tokens to decentralized exchanges’ “liquidity pools” (basically vaults of coins on exchanges that aren’t controlled by one entity like Binance or FTX) for others to use for trading. In exchange for you providing your assets, you can receive a token reward from the platform and a percentage of the user’s trading fees.

- Trading: Rather than hold (or “HODL” in the crypto vernacular) your crypto, you can buy and sell your positions over a short time frame to generate a return. Traders can trade in a variety of ways and commonly use leverage to multiply their returns. Leverage is when traders borrow funds to increase their position size, so gains (and losses) are magnified.

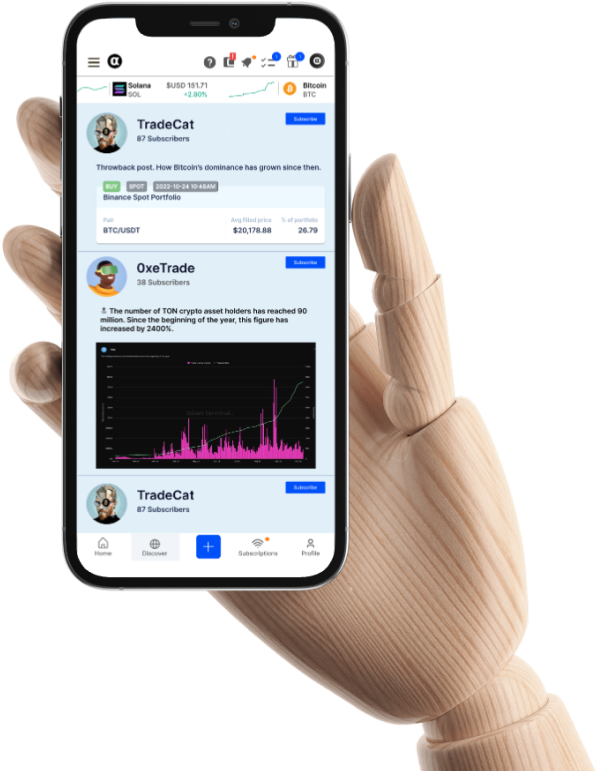

- Copy Trading: Instead of learning all of the skills and currencies yourself, you could also consider copy-trading via the Alpha Impact platform where you follow professional traders and trade crypto automatically based on their strategies. When you select a trader, you can see all of their past performance and determine whose risk appetite and results are aligned with your goals.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok