What’s the Difference Between Margin and Futures Trading?

Are you looking to add some new trading tools to your toolbox? You might consider margin trading, which lets you borrow funds to buy an asset now, or futures trading, which involves agreeing to sell something at a set price later on. Read on to learn more about the differences between these two advanced techniques.

Margin Trading

Trading on margin is a method of borrowing money from your broker — through a “margin loan” — to buy assets today.

Let’s say you want to buy 100 shares of a rising company but you only have the funds to buy 50. You can buy the other 50 shares “on margin” by borrowing from your brokerage firm, like Charles Schwab or Coinbase, by agreeing on the collateral and level of leverage for your position.

By giving you more funds for your investment, margin trading can amplify your wins and let you explore trades you might not otherwise. Yet since margin loans are tied to the fluctuating value of your collateral, a downside of margin trading is that you have maintenance requirements and margin calls. Overall, you run the risk of greater losses and hits to your credit.

Futures Trading

Futures trading or just “futures” refers to trading related to futures contracts, which are a kind of derivatives contracts where you agree to buy or sell an asset, at an agreed-upon date and price. To trade futures, you need a brokerage account and access to Commodity Futures Trading Commission (CFTC)-registered future exchanges, like CME Group or the National Stock Exchange of India. You might do this if you’re looking to buy or sell something in the future or if you’re looking to speculate on the contract itself.

Say you’re an oil distributor looking to lock in prices to protect against a price swing in the future. You can get an account on a futures exchange and a brokerage account that trades in futures. Then, you can draw up a contract with a buyer who, barring any extenuating circumstances, will purchase your goods on the agreed-upon date. In the meantime, future investors or speculators who aren’t interested in oil might seek to profit from price changes in your commodity futures contract.

Overall, futures trading allows you to manage your risks with price changes and potentially see huge gains. The downside is that futures trading is complex and it’s easy to get in over your head.

Final Thoughts

Both kinds of trading can lead to great gains but with both, you should always keep in mind the worst-case scenario and your bottom line. Even a seasoned trader can be overwhelmed by the market which is why it’s invaluable to have a network to rely on.

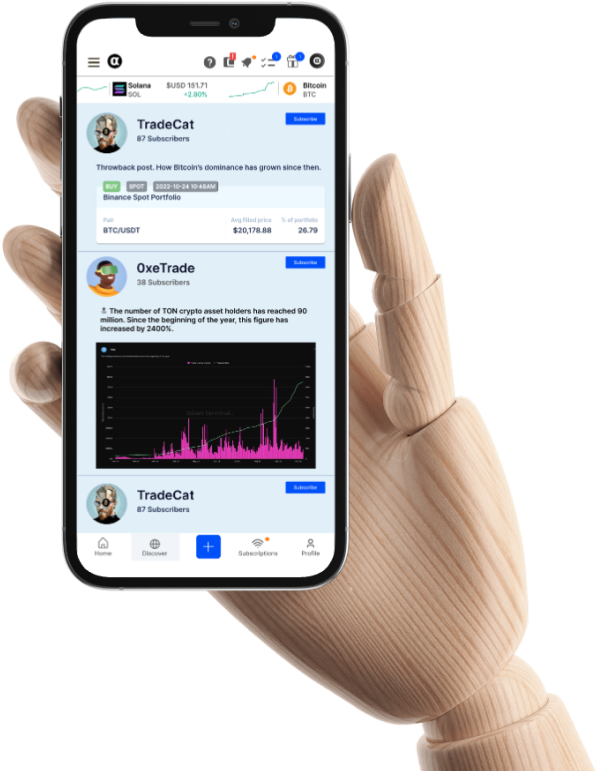

Alpha Impact offers a supportive, social community, where you can access market insights from top traders’ activities. From margin trading to futures trading, to day trading to investing, we’ve got you covered. Get started growing your portfolio and network today.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok