Tag TP/SL to BTC Mark Price | What’s New in App Release 8.6

Tired of micromanaging stop-losses and take-profit levels for individual crypto trades? Our latest risk management update helps you tie portfolio-level Take-Profit (TP) and Stop-Loss (SL) levels to Bitcoin Mark Prices.

*The words “Bitcoin (BTC) Mark Price” and “BTC Price” are used interchangeably in this article, but share the same meaning.

Remember to refresh our website and application for the latest updates.

💰 What is the Bitcoin (BTC) Mark Price?

Think of it as a reliable compass for the crypto world. Unlike the spot price, which can be influenced by individual exchanges, Bitcoin’s mark price gives you a more accurate picture of its true value. It’s like averaging prices from many exchanges to get a fair and balanced view.

✅ How does this help me?

Previously, we offered portfolio-level TP/SL levels triggered by your entire portfolio balance. Now, with our exotic BTC Mark Price Triggers, you can:

- Maximize Profits: Capitalize on broader market trends and not individual trade volatility

- Make Informed Decisions: Gain expanded protection against outlier movements and potential liquidation

- Enhanced Portfolio Performance: Set the foundation for a better-performing portfolio

*TP/SL are ways to manage risk. A TP trigger allows you to secure profits, especially in volatile markets. Meanwhile, an SL order helps you limit potential losses. If you’d like to learn how to set up TP/SL levels on Alpha Impact, you can check out our guide here.

🤖 How does BTC prices affect TP/SL?

Your TP and SL levels will be triggered once BTC mark prices reaches that specific level. Choose a strategy that suits your risk tolerance:

- Play it safe: Set your TP at 10% above and your SL at 5% below the current BTC mark price.

- In the middle: Consider a TP of 20% above and an SL of 10% below.

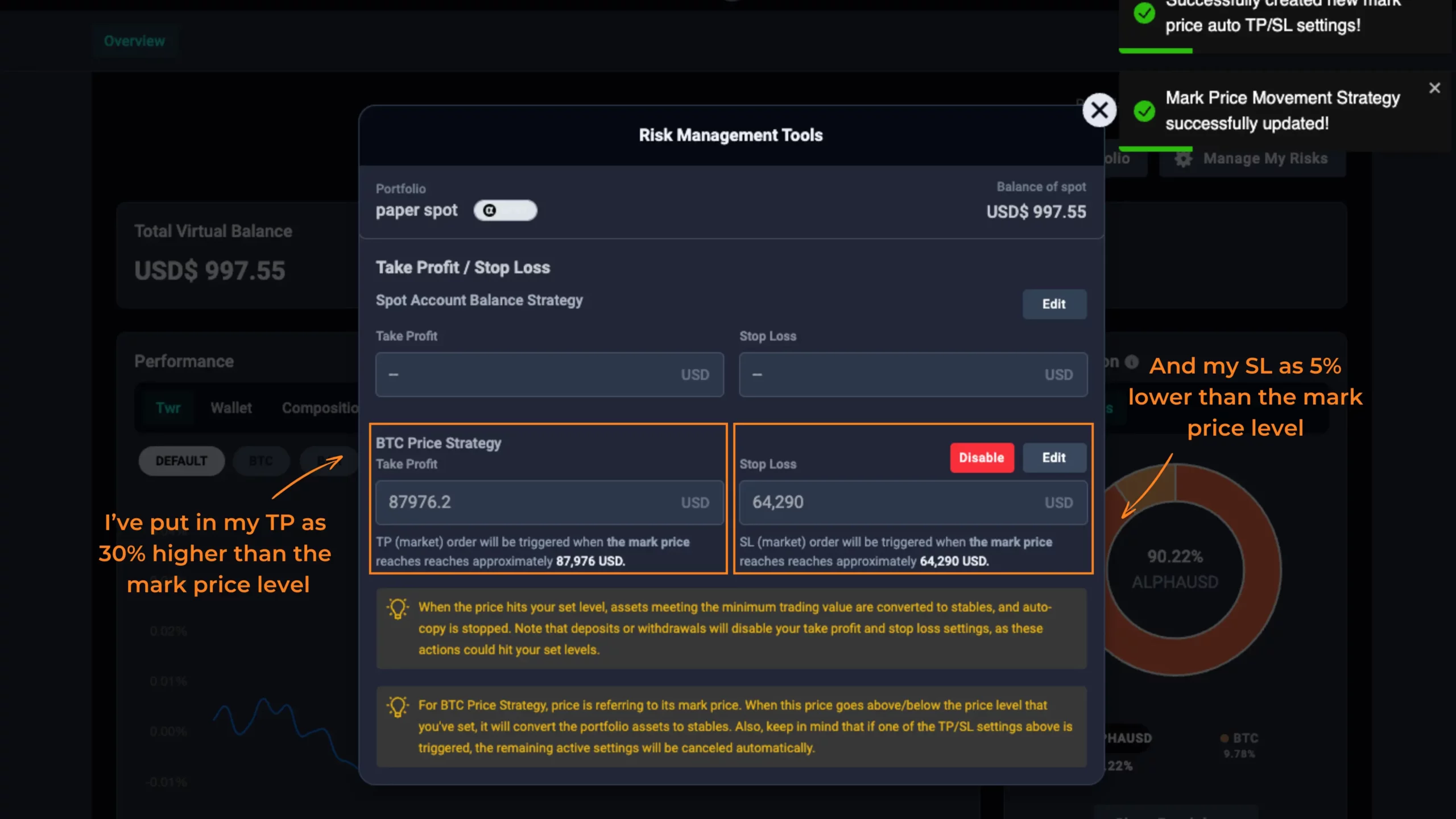

- Risk-takers: Go for a TP of 30% above and an SL of 5% below.

And remember, our TP/SL levels are completely hidden from market makers and exchanges, ensuring your trades are executed without interference.

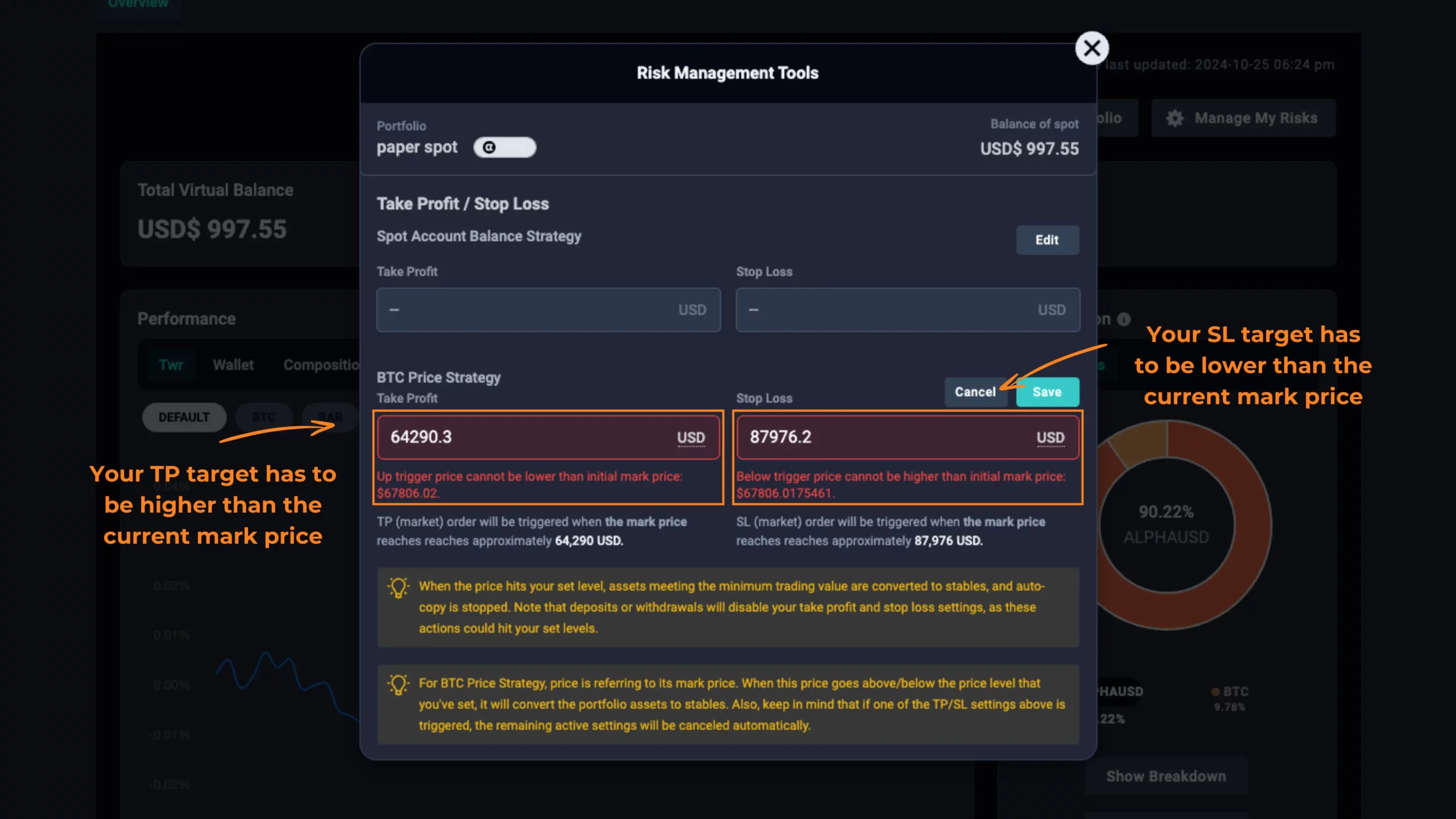

📈 Get Started

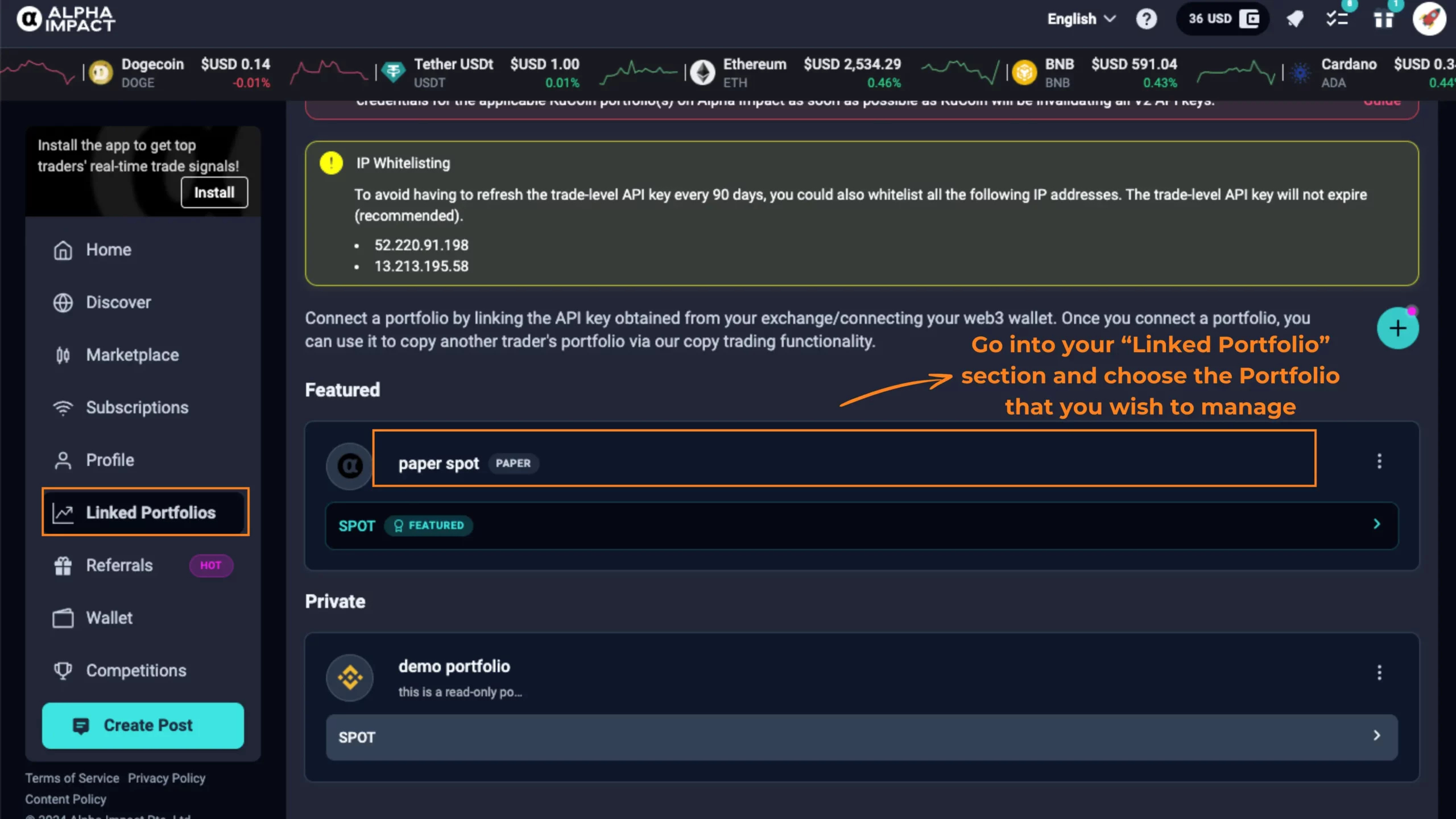

- Step 1: Navigate to your linked portfolio.

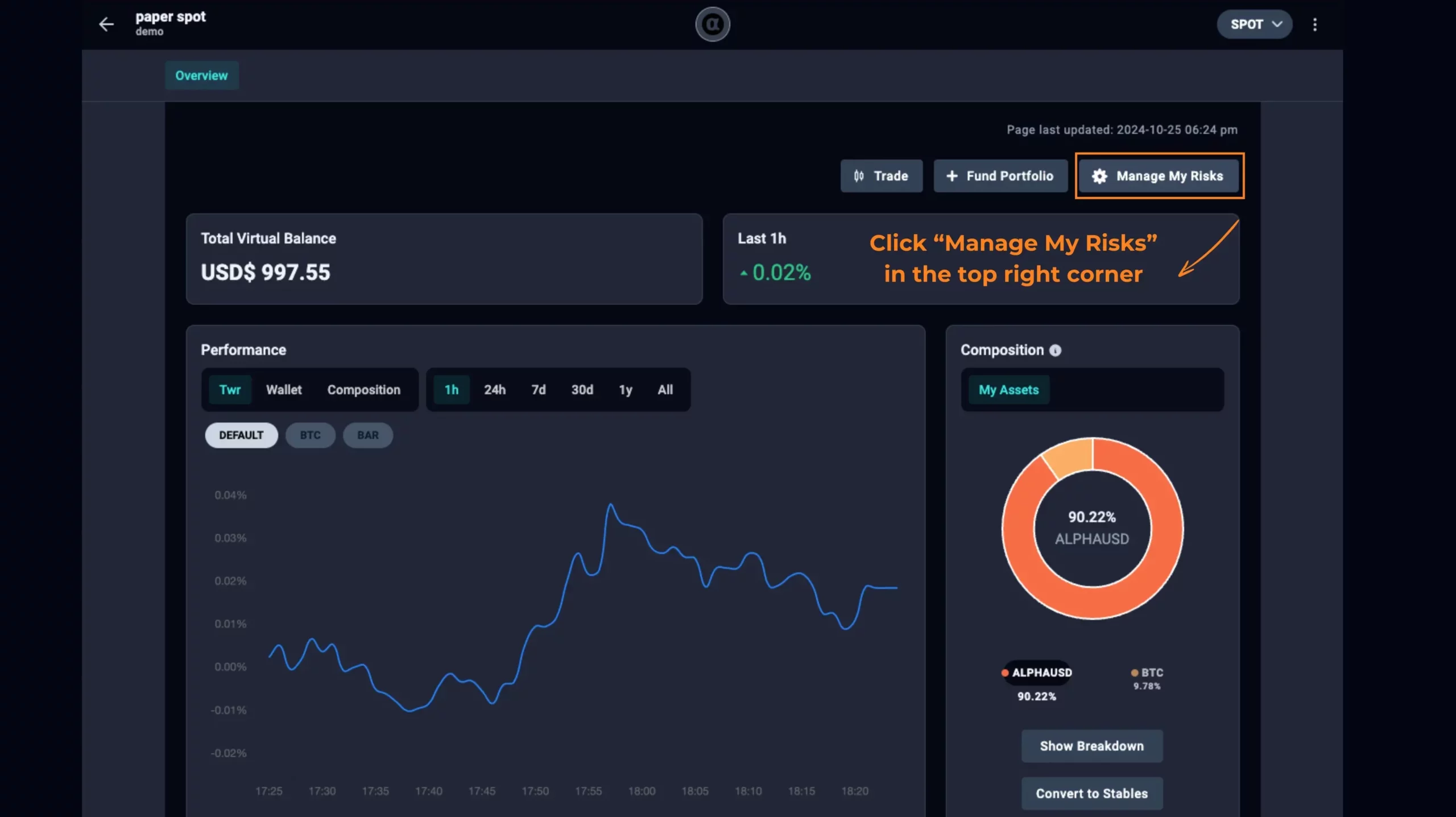

- Step 2: Click “Manage my Risks.”

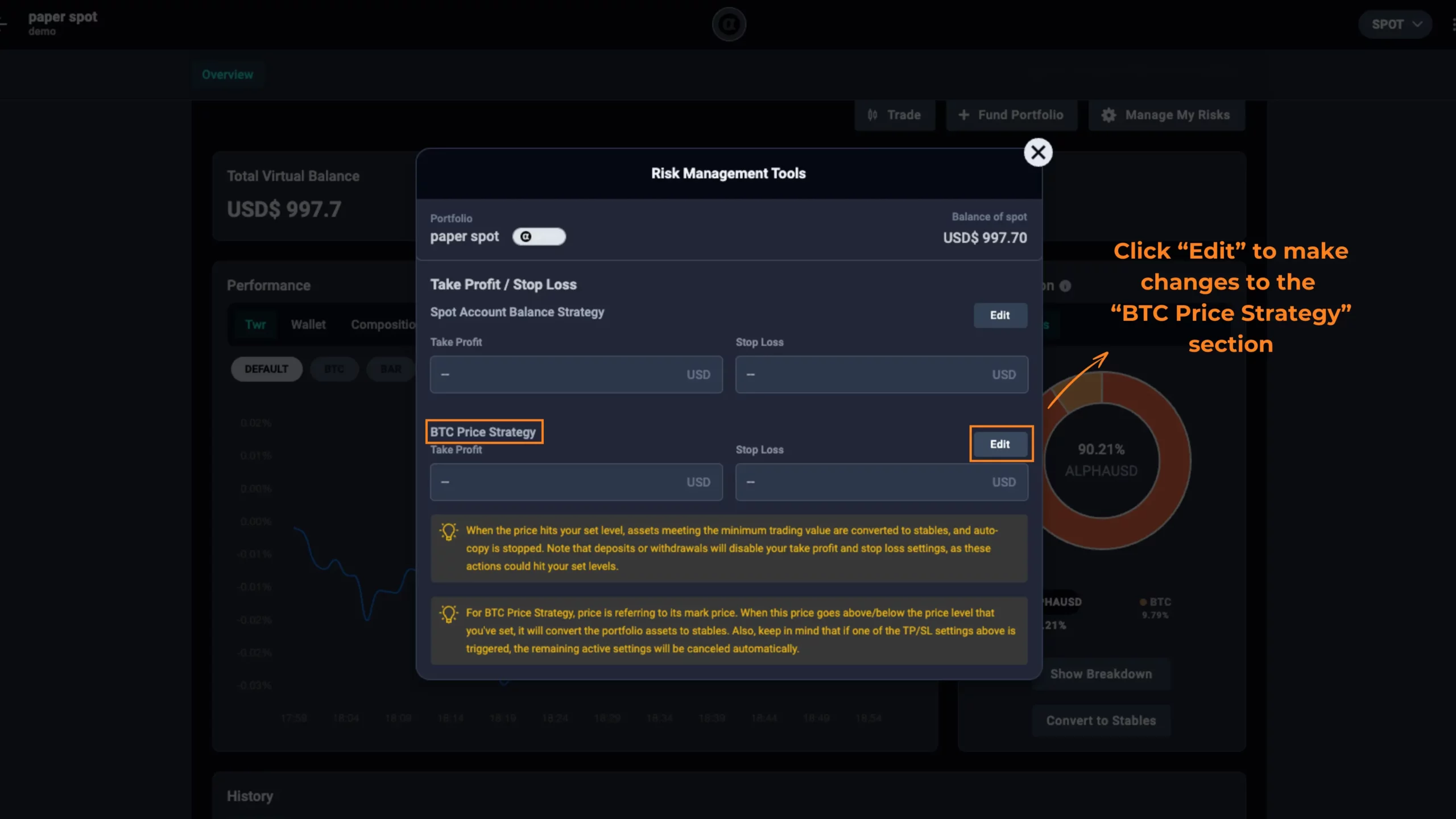

- Step 3: Select “BTC Price Strategy.”

- Step 4: Set your desired TP/SL levels.

*Take note: Your TP level should be higher than the current mark price, and your SL level should be lower. If the values are inaccurate, a prompt will emerge asking you to revise your current levels.

*Reminder: While BTC Mark Price Triggers can simplify your trading, it’s important to maintain a hands-on approach. Regularly review your risk tolerance and adjust your TP/SL levels to align with your investment goals. Stay informed about market trends and experiment with different settings to find the best strategy for you.

📊 Manage More With Us

But wait, there’s more! We turn technical jargon into actionable insights so you can make impactful trading decisions.

- Manage multiple portfolios from Binance, Kucoin, and Metamask.

- Compare performance analytics with detailed charts, historical composition data, and sharpe ratios across portfolios.

- Benefit from advanced risk management tools that protect your investments and diversify risk.

Ready to take the next step? Refresh our app and sign up for a free account today!

BTC Mark Price Trigger FAQ

1. What are BTC Mark Price Triggers?

- BTC Price Triggers is a new feature on Alpha Impact that allows you to set your Take-Profit (TP) and Stop-Loss (SL) orders based on Bitcoin’s mark price, which is a more accurate representation of its true value.

2. Why should I use BTC Price Triggers?

- By using BTC Price Triggers, you can align your trading strategies with the broader market trend, reduce your exposure to individual token volatility, and improve your overall risk management.

3. Can I use this with all of my trades?

- Yes, you can use BTC Price Triggers are set at the portfolio-level (rather than individual trades) on Alpha Impact.

4. How do I set my TP/SL levels based on BTC Prices?

- To set your TP/SL levels based on BTC Price, simply navigate to your linked portfolio and edit your TP/SL settings. You can choose to set your TP/SL levels as a percentage above or below the current BTC Price.

5. Can I change my TP/SL levels after setting them based on BTC Price?

- Yes, you can modify your TP/SL levels at any time before they are triggered.

6. What if BTC price fluctuates significantly after I set my TP/SL levels?

- BTC Price Triggers helps to mitigate the risk of sudden market swings by aligning your trades with the broader market trend.

7. Is BTC Price Trigger suitable for all trading styles?

- BTC Price Trigger is particularly beneficial for traders who want to align their strategies with the broader market trend and reduce their exposure to individual token volatility. However, it may not be suitable for all trading styles. It’s important to consider your individual risk tolerance and investment goals before using this feature.

8. Should I set my TP and SL triggers to my portfolio balance or BTC price?

- Whole Portfolio Balance TP/SL is suitable for those who want to focus on the performance of their individual portfolio, whilst BTC Price TP/SL is suitable for those who want to align their trading strategy with the broader market trend and diversify their risk.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok