The moves of financial markets, whether traditional or crypto, are driven by several factors, including investor sentiment, macroeconomic circumstances, and market behaviour. Based on these factors, two of the most common market cycles are bull markets and bear markets.

These opposing financial market trends impact how people invest in various assets, leverage opportunities, and manage risks. To help you better understand these cycles, we have done a detailed study of market sentiment analysis. This article offers valuable insights into the relation between market performance and participants’ moods.

What is a Bull Market?

A bull market is when the price of underlying assets or commodities increases sustainably over a period. Optimism, confidence in assets’ performance, and the expectation of strong results dominate investor sentiment, which in turn drives the market rally.

In a bull market, the assets’ prices increase driven by robust economic performance, unemployment decreases, and consumer spending rises. Investors’ appetite for risk increases, driving more demand for underlying assets.

Bull markets can last for days, weeks, months, or sometimes, years, like the post-2009 recovery following the 2007-2008 financial crisis.

What is a Bear Market?

A bear market is just the opposite of a bull market. It reflects a sustained decline in asset prices over a period. The decline usually exceeds 20% from recent highs. It indicates negative market sentiment, lower investor confidence and heightened pessimism about economic growth.

In a bear market, asset prices fall, unemployment increases, GDP declines, and monetary policies are tightened. Investors in a bear market often shift their attention (and investments) to safer assets like gold, bonds, or cash.

Similar to bull markets, bear markets can last for days, months, or years, as seen during the 2007-2008 recession.

Market Sentiment And Its Impact on Financial Cycles

Market sentiment refers to the ongoing perspective of investors toward the current market condition or a particular asset class. It’s a psychological factor that is said to have the biggest impact on whether a bull or bear market emerges.

For example:

A bullish cycle is driven by positive market sentiment, optimism, favourable news, or promising economic indicators.

A bearish cycle is generally triggered by negative investor sentiment, including fear of loss, negative events, or degrading macroeconomic conditions.

Tools for Sentiment Analysis

Wondering how to analyse market sentiment correctly? Well, there are tools and techniques for sentiment analysis through data-driven methods. Some major tools and elements include:

- Sentiment Indicators: Metrics like the VIX (Volatility Index), also called the “fear index,” can be monitored to analyse market anxiety.

- Social Media Analysis: Algorithms can track sentiment on social platforms based on user content, discussions, and behaviour.

- Economic Reports: Consumer confidence surveys and macroeconomic reports offer insights into prevailing sentiment.

Navigating Bull and Bear Markets with Modern Technology

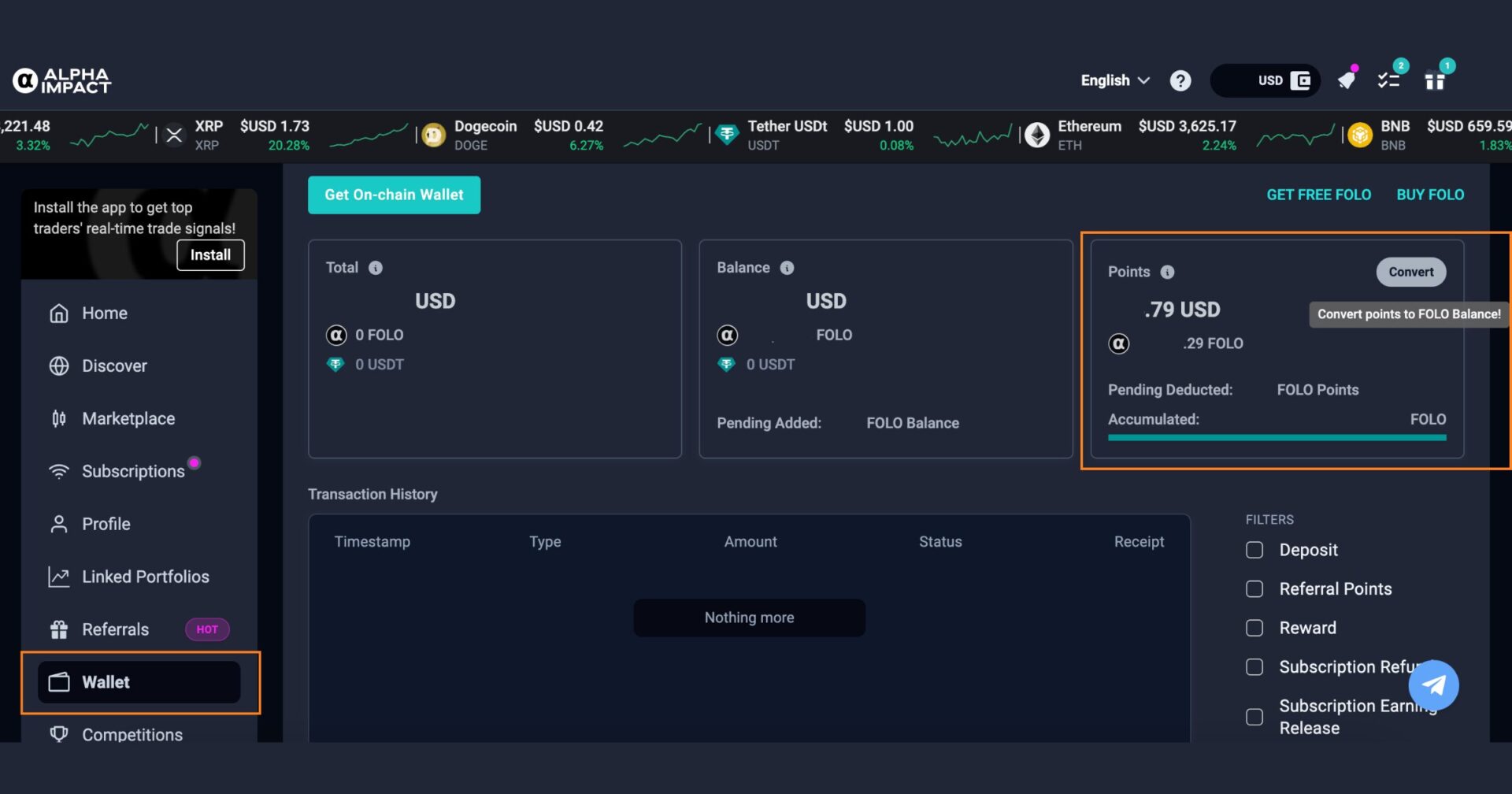

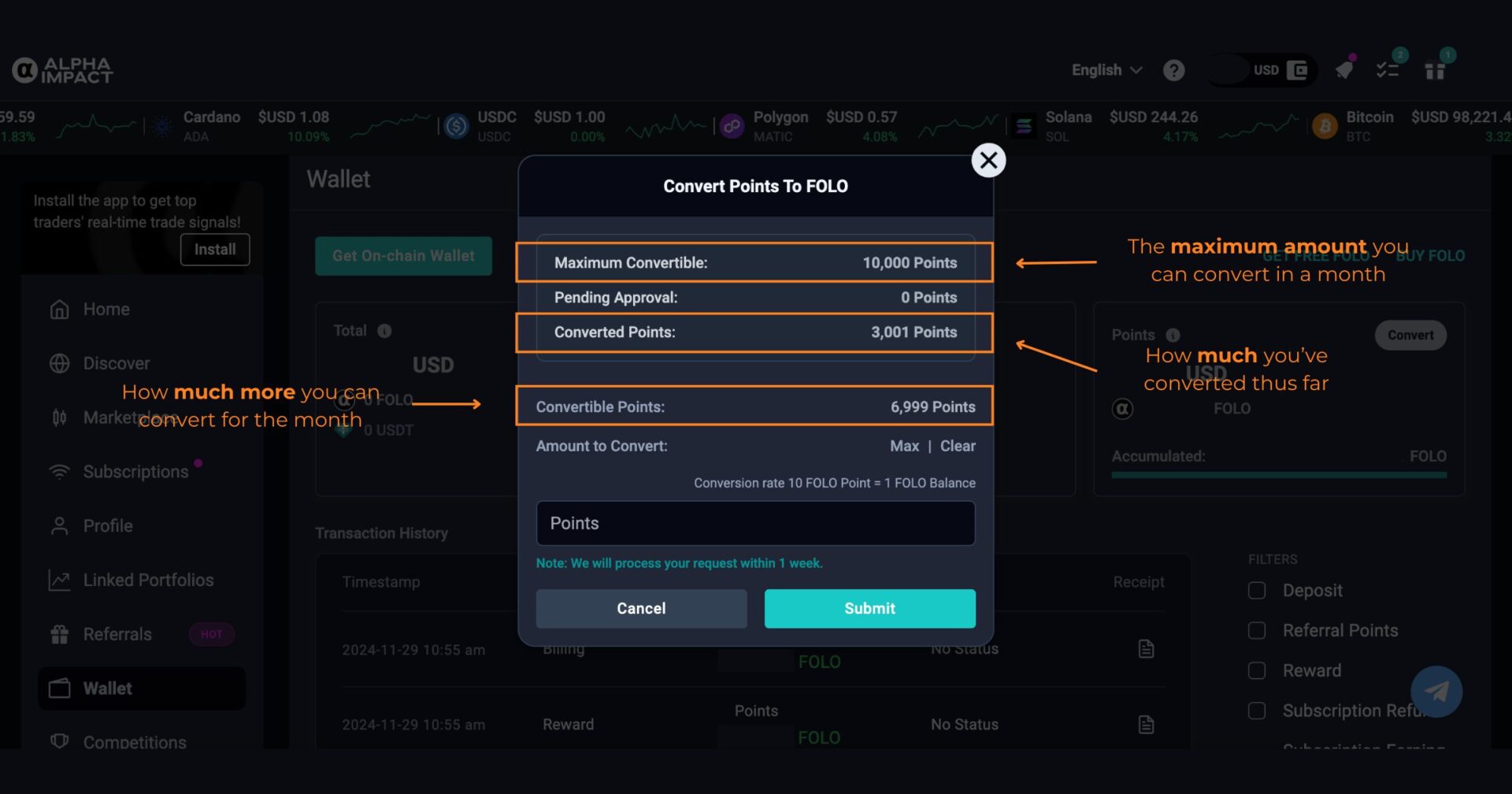

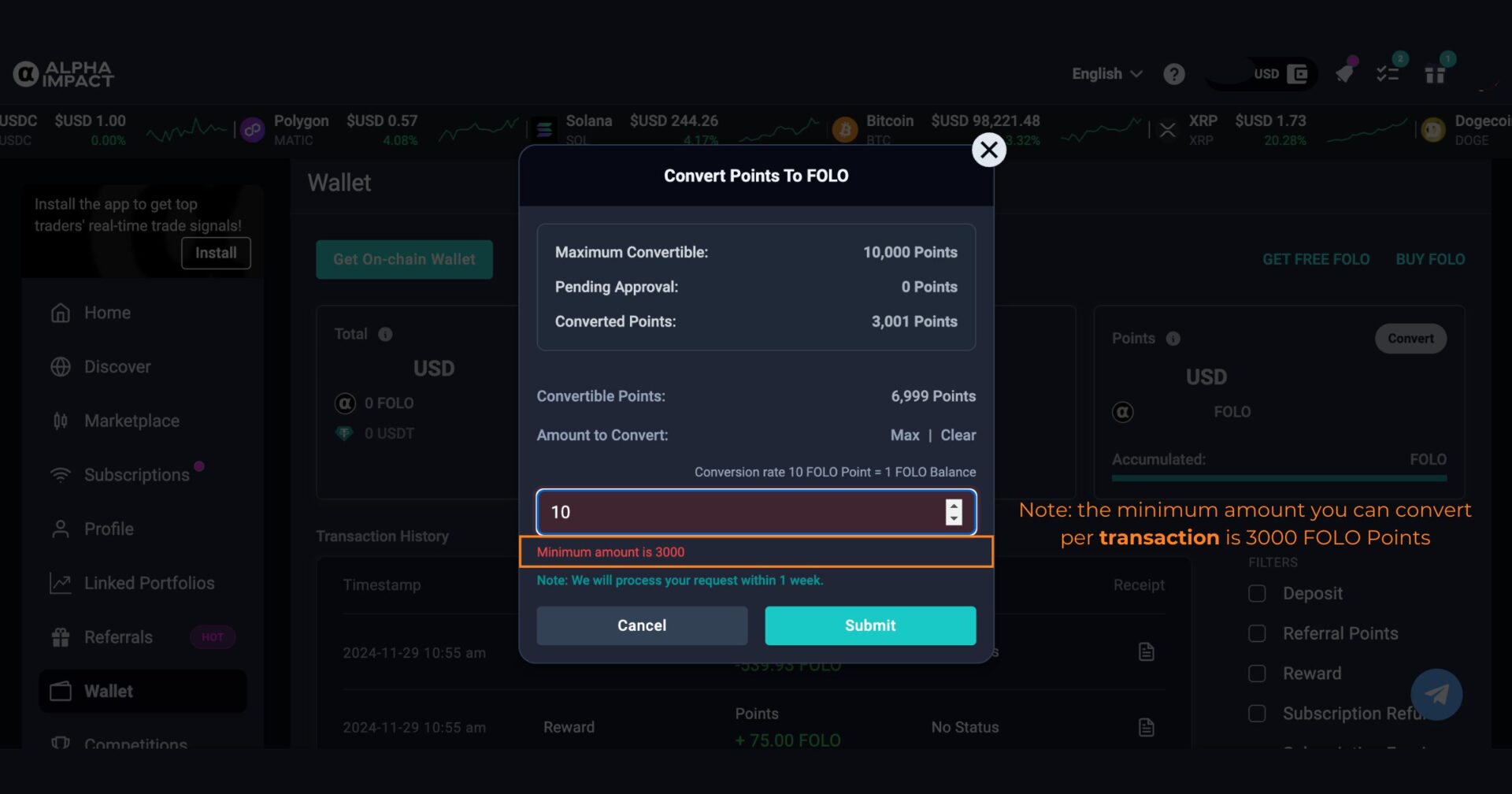

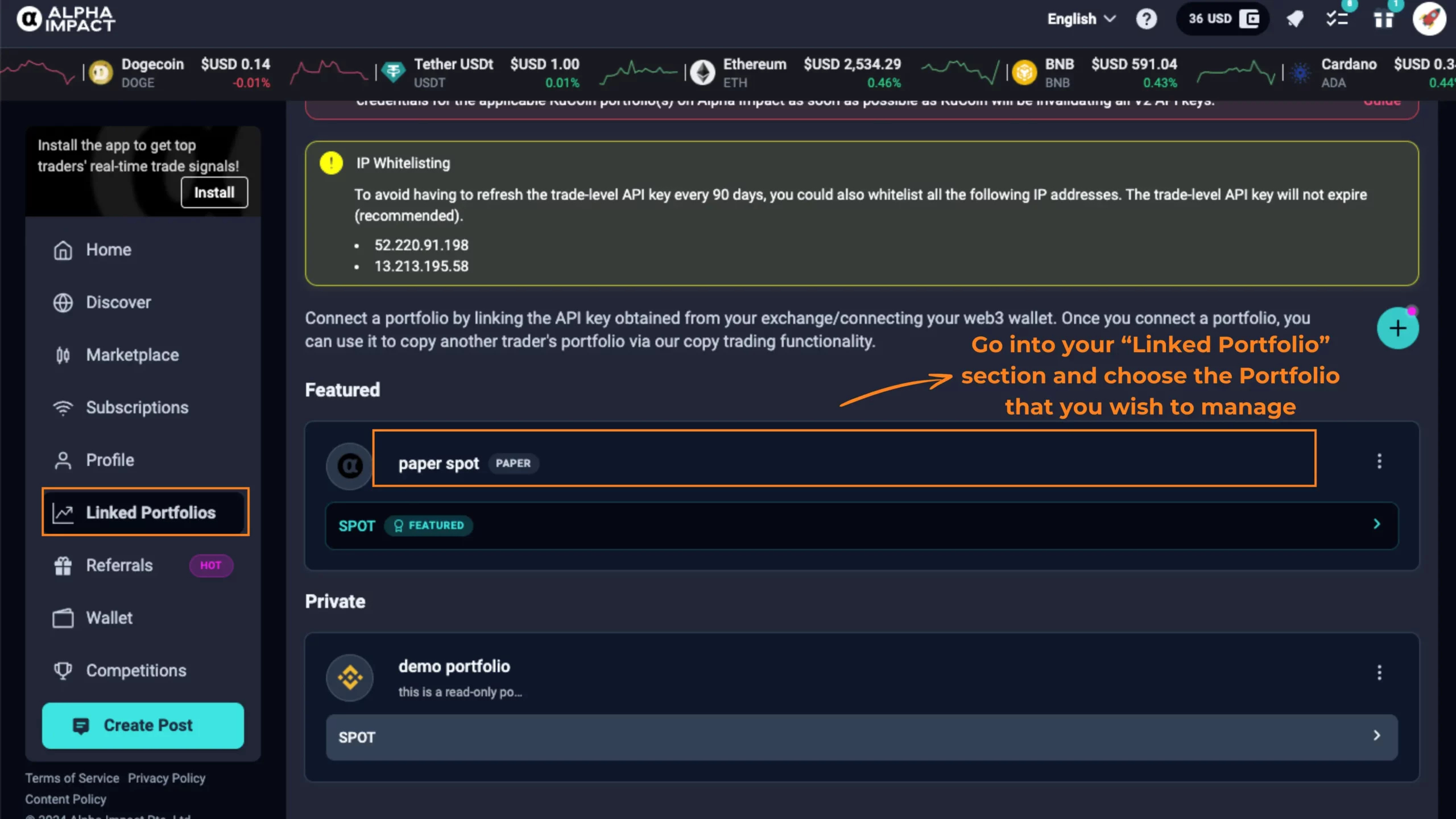

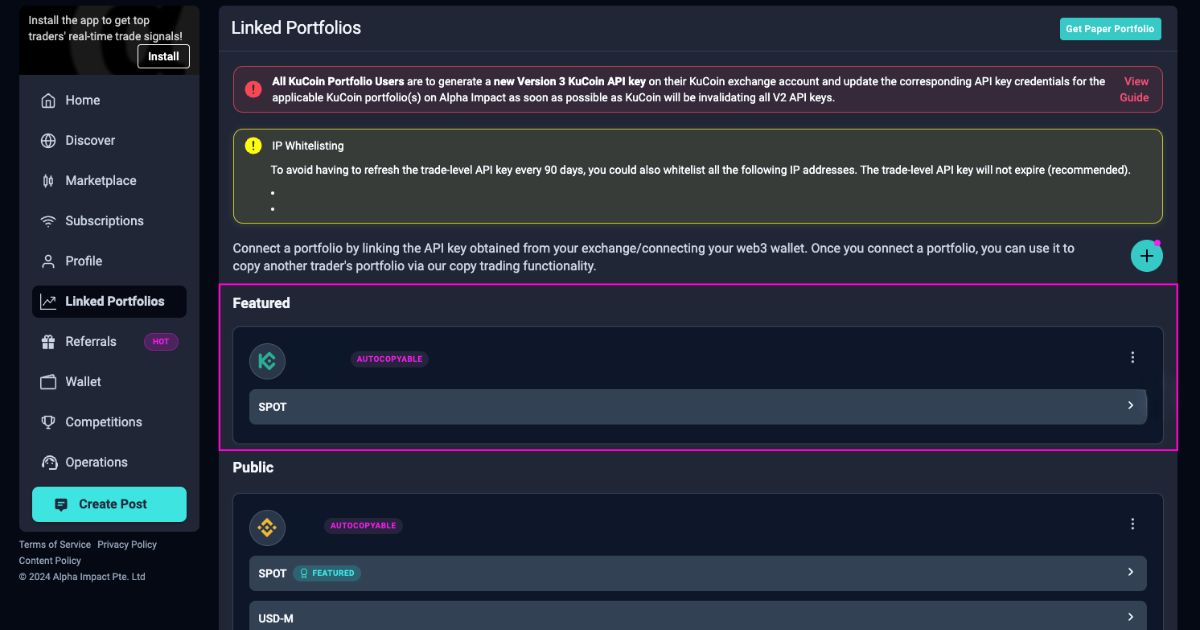

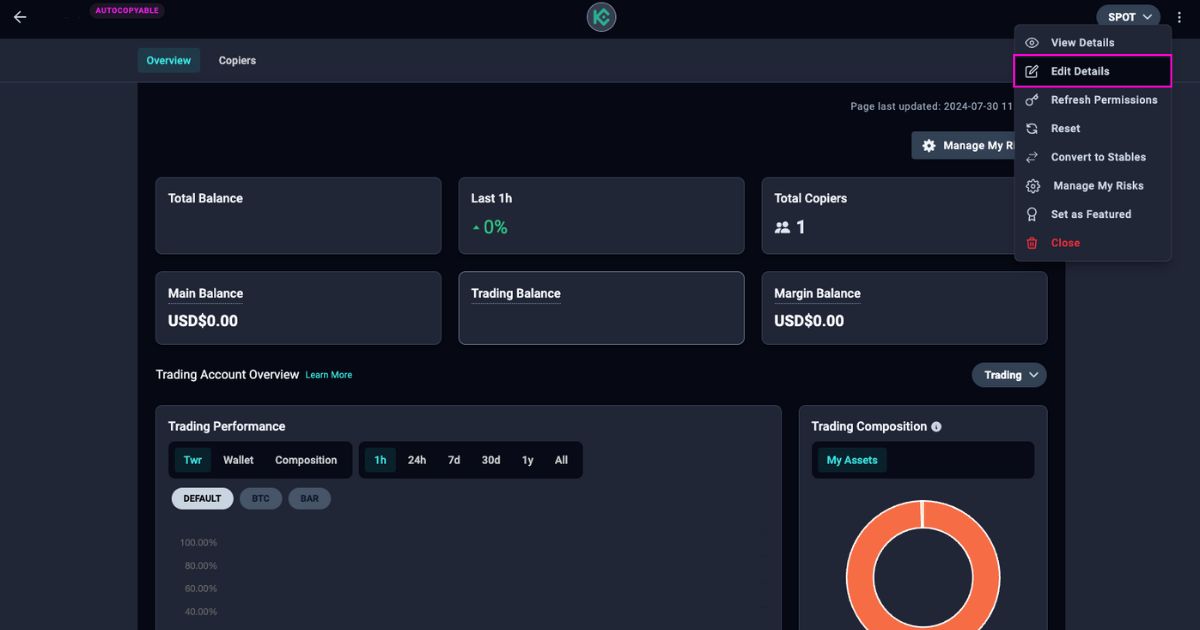

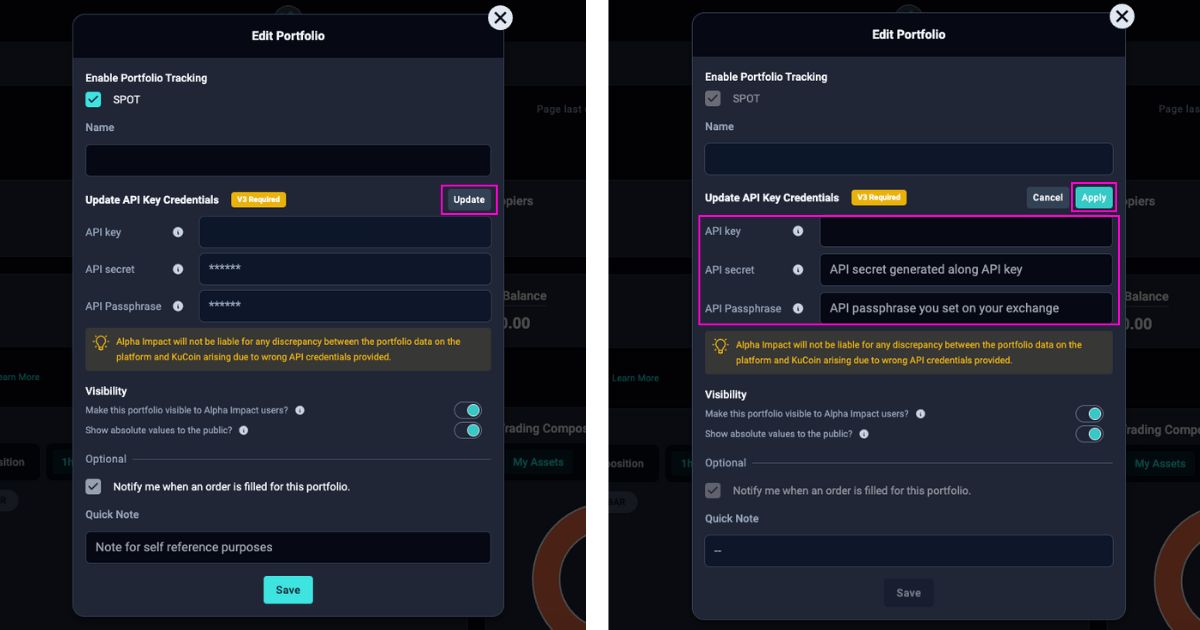

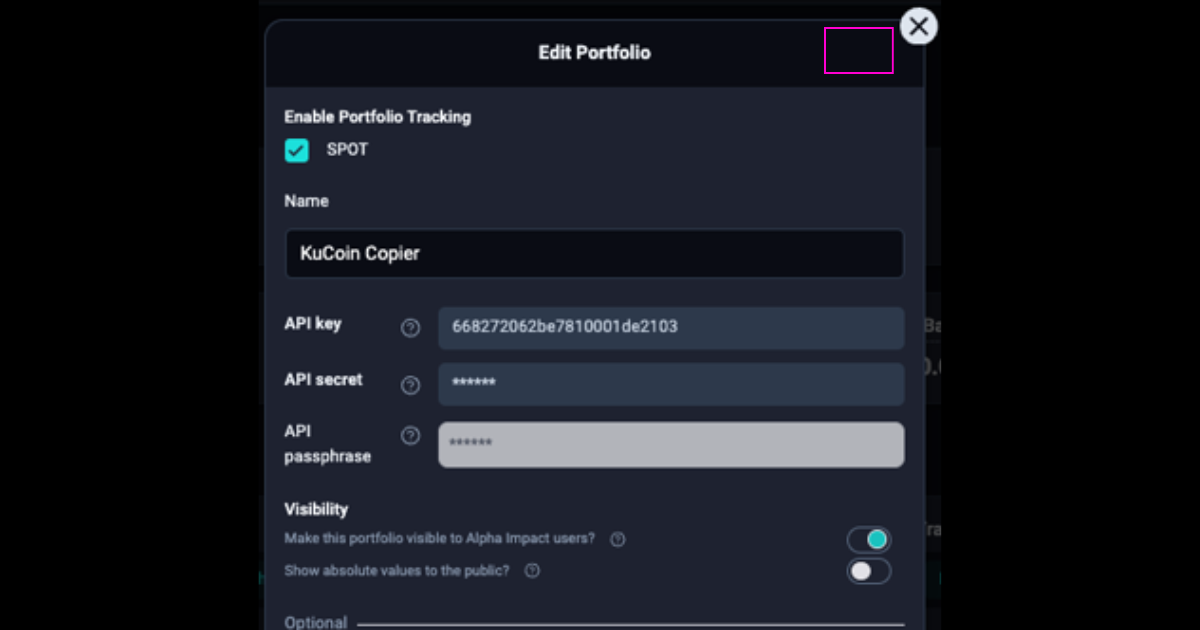

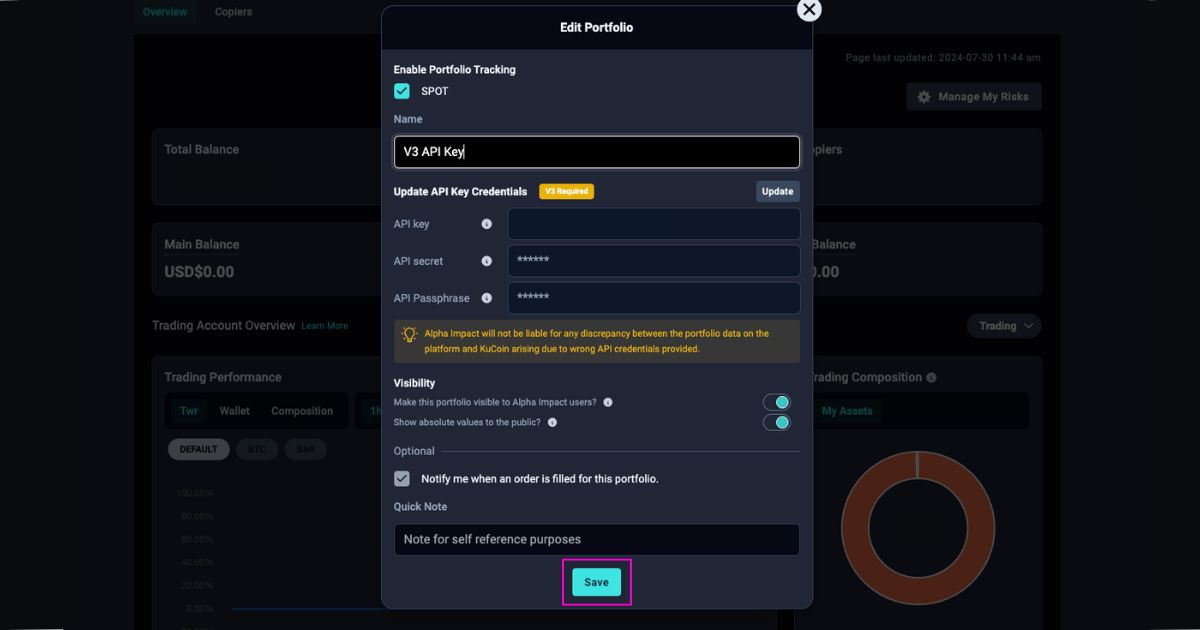

Platforms like Alpha Impact are revolutionising how investors and traders behave in different market cycles. They provide tools to help investors make data-driven investment decisions based on proven strategies in any market condition. As a non-custodial technology platform, Alpha Impact connects investors with seasoned traders, allowing them to copy successful trades and strategies in real-time.

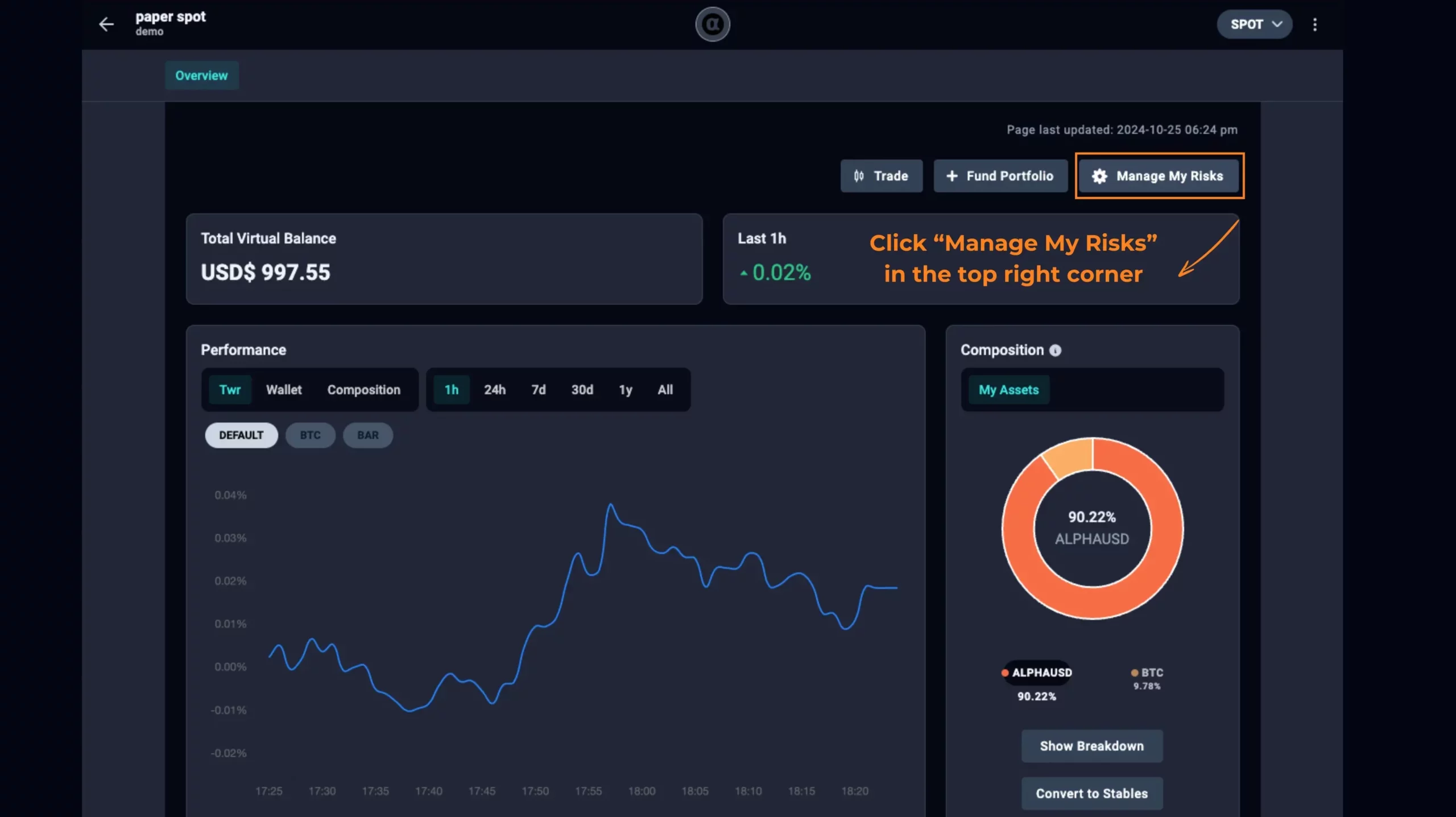

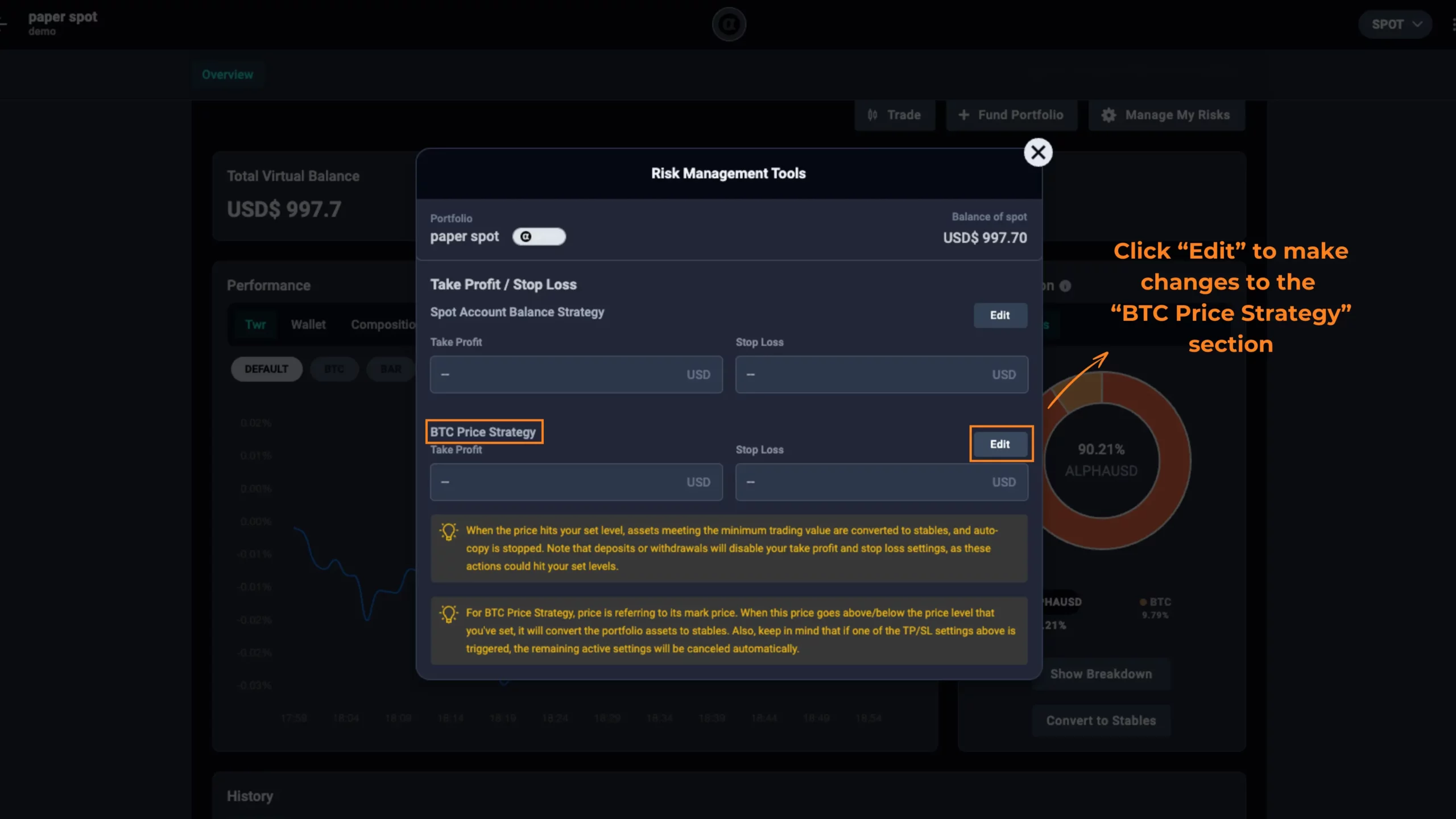

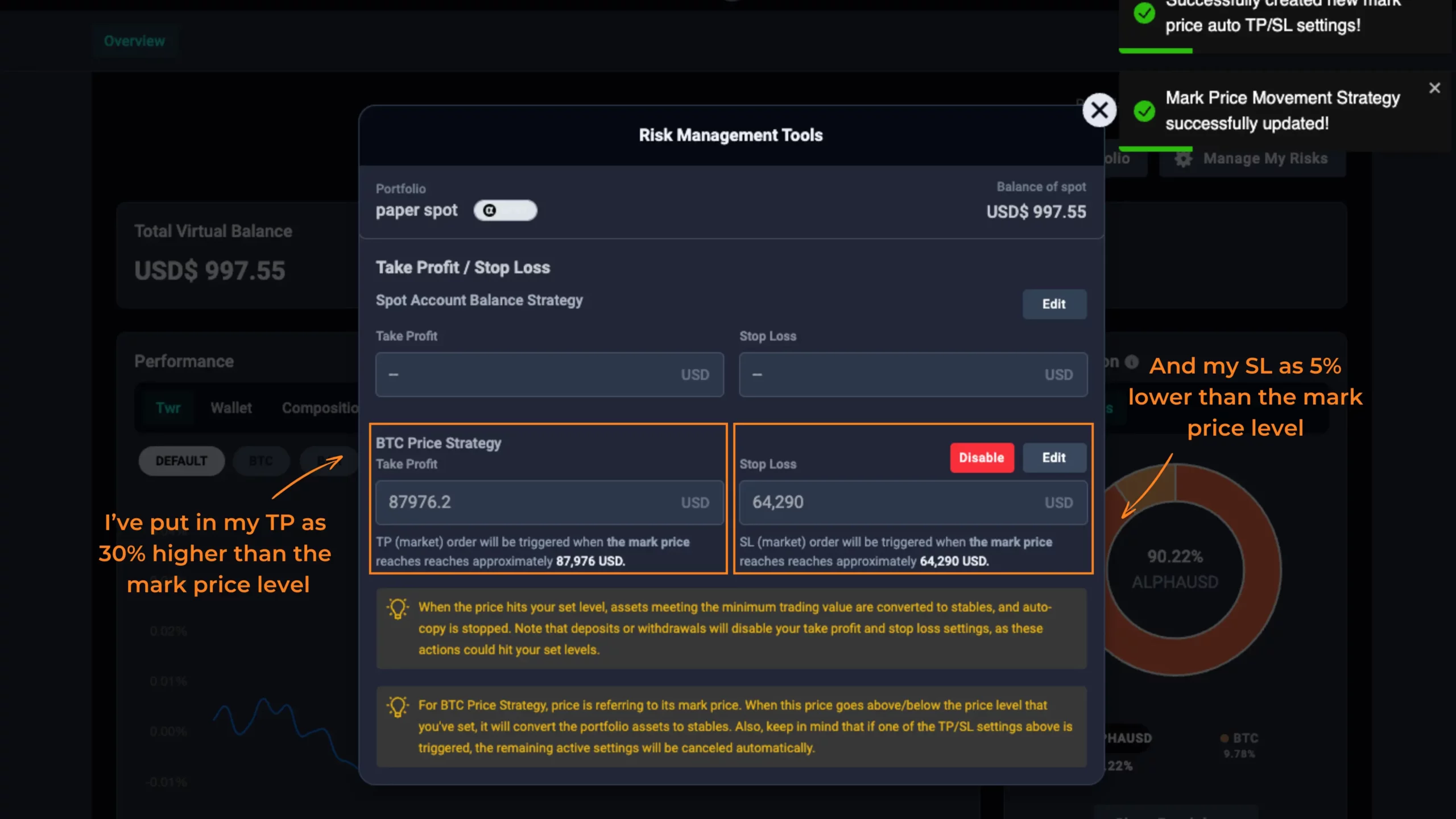

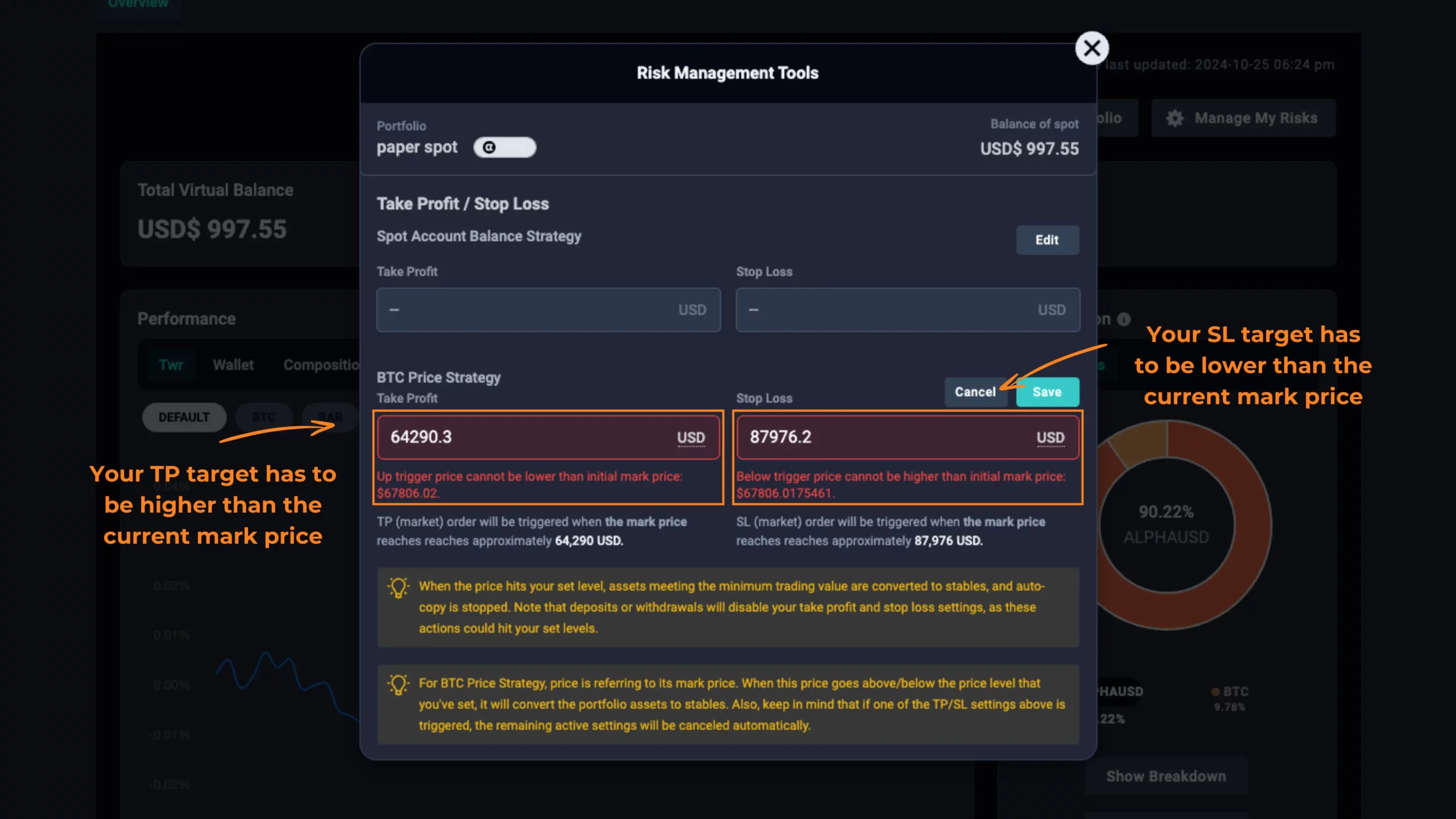

Whether in a bull market where maximising returns is the goal or a bear market where the focus is more on managing risks, Alpha Impact offers tools, such as Comprehensive Portfolio Management, Robust Risk Management, and Complete Accessibility, allowing investors to benefit from expert strategies to navigate volatile market cycles safely.

Practical Strategies for Bull and Bear Markets

Here are some effective strategies for managing risks and reducing losses (or increasing profits) during different market cycles:

In a Bull Market:

- Stay Invested: Selling too early or without planning can result in missed opportunities.

- Diversify: To benefit from the growth of different sectors, particularly emerging trends and technologies like AI and blockchain.

- Avoid Overconfidence: Trade carefully. Avoid over-investing in a particular asset. Rising prices can sometimes lead to unexpected falls in the future.

In a Bear Market:

- Invest in Low-risk Assets: Allocate more funds to defensive assets such as bonds or gold.

- Stay Invested: Do not liquidate your investments out of fear.

- Buy More: Falling prices offer an opportunity to buy more quality assets at a discount.

Conclusion

Understanding bull and bear markets is crucial for successfully navigating the complexities of financial markets and making decisions driven by data rather than emotions. Market sentiment analysis helps one understand how sentiments drive different market cycles and how investors can adapt their strategies accordingly. Platforms like Alpha Impact are empowering investors to make data-driven decisions backed by expert insights and cutting-edge technology in any market condition.