How Global Tariffs Could Reshape Crypto Trading Trends in 2025

The global financial landscape is undergoing a remarkable transformation in 2025, largely driven by the new wave of tariffs introduced by President Donald Trump this April. With a universal 10% import duty on all goods and steep country-specific tariffs — including a 104% levy on Chinese imports — these policies are sending ripples through traditional markets and creating surprising opportunities in the cryptocurrency space.

At Alpha Impact, we’re tracking these developments closely to help our users navigate this evolving economic environment through our social trading platform.

Tariffs and Crypto: Unexpected Relationships

In late February, the cryptocurrency market reacted notably following President Trump’s confirmation of new tariffs on Canada and Mexico. While conventional wisdom suggests digital assets would remain isolated from government trade policies, recent market behavior tells a different story.

Tariffs — taxes imposed on imported goods and services — influence currency values, stock markets, and consumer spending patterns well beyond the directly taxed industries.

Recent Market Movements: Diverging from Traditional Assets

When President Trump announced the new tariffs, traditional markets responded with immediate volatility. Major U.S. indices dropped nearly 10% over just two days.

CoinShares research shows digital asset investment products saw $795 million in outflows over a week, nearly erasing all inflows seen earlier in the year. Despite these outflows, a late-week recovery raised total assets under management to $130 billion, up 8% from the April 8 low, coinciding with a temporary tariff rollback.

Among specific cryptocurrencies (within the one-week span):

- Bitcoin experienced the highest weekly outflows at $751 million but maintains positive year-to-date flows of $545 million

- Ethereum faced $37.6 million in weekly outflows but retains $241 million in year-to-date inflows

- XRP bucked the trend with $3.5 million in inflows and has attracted $176 million in inflows this year

“Despite the carnage in traditional financial markets, the crypto markets have been relatively orderly,” noted NYDIG global head of research Greg Cipolaro in an April 11 note, suggesting growing market maturity amid economic turbulence.

Regional Investment Patterns

The United States saw $763 million in fund withdrawals last week, with monthly outflows totaling $924 million. Switzerland and Hong Kong followed with $11.9 million and $11.2 million in weekly outflows.

Some regions showed resilience, with Canada recording inflows of $2.1 million, while Australia and Brazil saw modest additions. These regional differences suggest varying confidence levels in crypto’s ability to weather economic uncertainty.

Crypto perpetual futures rates remained “persistently positive,” with liquidations reaching only $480 million after the tariff announcement — “well below other notable liquidation events,” according to Cipolaro.

Emerging Crypto Trends in Response to Tariffs

As global trade becomes more complex due to rising tariffs, several key trends are emerging:

1. Stablecoins and Cross-Border Payments

With international banking fees rising and risk premiums increasing, stablecoins like USDT and USDC are gaining wider adoption for cross-border payments. Businesses are increasingly using these digital assets to bypass excessive currency conversion costs and transfer delays, maintaining commerce flows despite trade barriers.

This claim is backed up by Cipolaro, which notes that whilst Tether (a US dollar-tracking stablecoin widely used token in crypto trading) was trading below $1 but had “not experienced a sharp decline.”

2. DeFi Creating New Financial Pathways

As access to international markets becomes more restricted due to retaliatory tariff actions, alternative finance platforms offer secure borrowing, lending, and other financial services without traditional intermediaries. This provides crucial financial infrastructure in economies affected by tariff-induced disruptions.

3. Derivatives Offering Risk Protection

The uncertainty surrounding tariffs has driven traders toward crypto derivatives like futures and options to protect capital against volatility. These instruments, once primarily available to institutional investors, are now accessible to broader markets, providing risk management tools during economic uncertainty.

4. Digital Finance Adoption in Emerging Markets

Emerging markets are often the first to bear the brunt of such global economic volatility. In nations facing the biggest fallout from tariff wars through supply chain disruptions and inflation, both individuals and organisations are turning to crypto to diversify their assets and preserve wealth across global markets. Countries in Southeast Asia, Latin America, and Africa have particularly recorded notable growth in crypto wallet creation and on-chain activity in recent months.

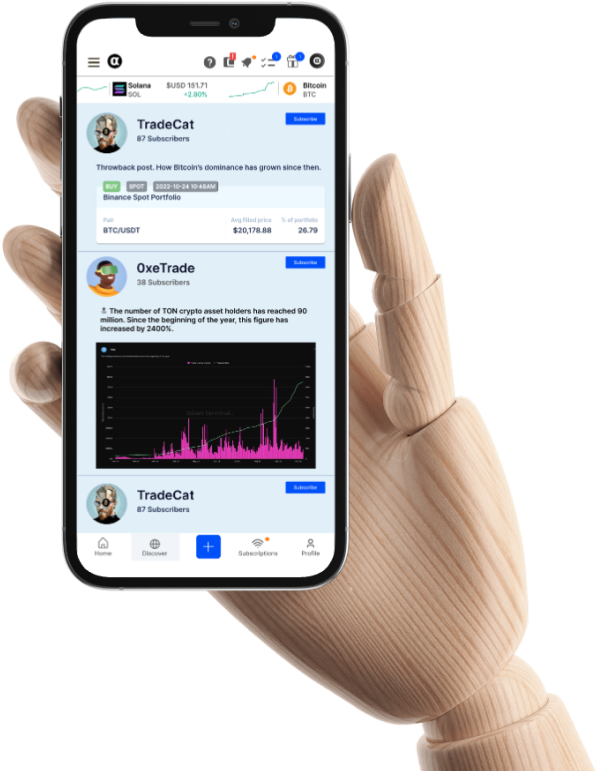

Alpha Impact and Social Trading

While traditional markets remain heavily influenced by large institutions, the cryptocurrency space offers greater accessibility in comparison. Alpha Impact’s social trading platform empowers investors globally by allowing them to follow and replicate the trades of successful, verified crypto investors.

In this environment of economic uncertainty and tariff challenges, Alpha Impact provides participants with a simplified entry point to navigate the cryptocurrency landscape. By connecting users with experienced traders who understand market dynamics during periods of trade tension, the platform helps investors capitalise on emerging opportunities while managing downside risks.

Conclusion: US Tariffs – A Turning Point for Global Finance?

The tariffs of 2025 may mark a pivotal moment for global finance, accelerating the adoption of digital assets. As traditional commerce faces friction, cryptocurrencies offer convenient, secure alternatives for transactions and investments.

The cryptocurrency market has demonstrated remarkable resilience amid economic turbulence. For investors navigating this landscape, Alpha Impact provides valuable tools to participate in what may be the next chapter of financial history — a world where cryptocurrencies become an integral component of the global financial system.

Note: Alpha Impact is working towards an on-chain platform, which will bring even greater transparency and verifiability to our community.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok