Manage Risk with Us: A Guide to TP/SL Levels

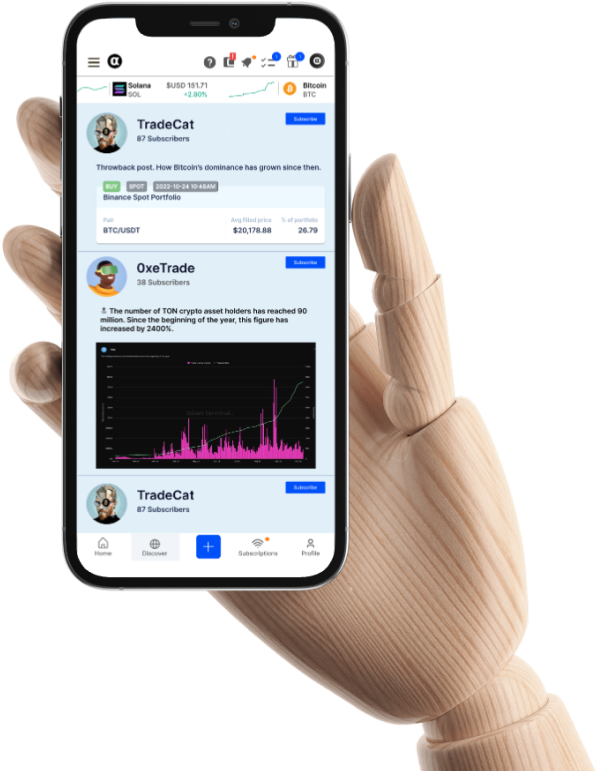

Take-Profit and Stop-Loss (TP/SL) orders are essential tools for any crypto trader looking to protect profits and reduce risks. Alpha Impact provides a powerful platform for setting up and managing these orders, with additional features to enhance your trading strategy.

📊 Understanding TP/SL

TP (Take-Profit) refers to locking in profits when the price reaches your predetermined level, whilst SL (Stop-Loss) automatically sells your assets when the price falls to a set point, limiting potential losses.

At Alpha Impact, these are either:

- Triggered by Portfolio Balances or Bitcoin (BTC) Mark Price: Choose between targeting your entire portfolio balance or using the BTC mark price for a more market-driven approach.

- One-Cancels-Other (OCO): If one level is triggered (TP or SL), the other is automatically canceled.

- Invisible to Exchanges: Protects your orders from market makers who might try to exploit them.

📈 Get Started with Us

- Go to your Linked Portfolio.

- Click “Edit” on the specific trade you want to manage.

- Input your desired TP and SL price levels.

- Click “Save” to confirm.

✅ Choosing the Right Trigger

- Portfolio-Based: Ideal for those who want a consistent approach to risk management based on their overall portfolio balance.

- BTC Mark Price: Suitable for those who want to align their trades with the broader market trend and minimize potential risk.

*BTC mark price is a more accurate reflection of Bitcoin’s true value, as it is calculated based on the Index Price and Moving Average Premium Index. If you’d like to learn more about BTC Mark Price, you can check out our latest release here.

📈 Setting Appropriate TP/SL Levels

Regardless, it’s essential to consider your risk tolerance and monitor market volatility conditions to determine if an adjustment is needed.

- Regularly review and adjust your TP/SL levels as market conditions change. In highly volatile markets, or if you hold more volatile tokens, you may want to set wider SL levels to avoid being prematurely liquidated.

- Experiment with different settings to find the best strategy for your trading style.

- Combine TP/SL with other risk management tools for a comprehensive approach.

TP/SL Guide FAQ

1. What are TP/SL levels, and why are they important?

- TP/SL levels are essential tools for managing risk in crypto trading. They allow you to automatically sell your assets at a predetermined profit (TP) or loss (SL) level, helping you protect your investments and secure profits.

2. How do they work on Alpha Impact?

- On Alpha Impact, you can set TP/SL levels for your entire portfolio balance or the Bitcoin mark price.

3. What is the difference between portfolio-based and BTC mark price trigger?

- Portfolio-Based: Your TP/SL levels are calculated based on the total value of your portfolio, providing a consistent approach to risk management.

- BTC Mark Price: Your TP/SL levels are linked to Bitcoin’s price, allowing you to align your trades with the broader market trend and potentially minimize risk.

4. How do I set up my levels on Alpha Impact?

- To set up TP/SL levels, navigate to your linked portfolio, click “Edit” on the specific trade, and input your desired TP and SL price levels.

5. Can I modify my levels after setting them?

- Yes, you can modify your TP/SL levels at any time before they are triggered. Simply go to your linked portfolio and edit the relevant trade.

6. What happens if both my levels are triggered?

- Alpha Impact uses a One-Cancels-Other (OCO) strategy, meaning if one target is triggered (TP or SL), the other is automatically canceled.

7. Are my levels visible to external players?

- No, Alpha Impact’s TP/SL levels are completely hidden from market makers and exchanges, ensuring your trades are executed without interference.

8. How can I choose the best triggers for my trading strategy?

- Consider your risk tolerance, market conditions, and overall investment goals when setting TP/SL triggers. Experiment with different settings to find what works best for you.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok