Can I Quit My Job & Just Trade Crypto?

Crypto as a job? Unless you’ve been living under a rock, you’re bound to have been peppered with online ads promising vast riches by trading cryptocurrency from your own bedroom. Given that many people have been affected by the COVID crisis and either lost their jobs or are now working from home, it begs the question if this is really possible. Even if it’s true, how does your average person choose from all of these gurus, programs, and tips?

According to CNBC, the total cryptocurrency market cap breached US$2 Trillion in April 2021 which is around the same value as Apple. With some asset managers only able to deploy capital into asset classes with a market cap of over US$1 Trillion, crypto has suddenly emerged as an investable asset to larger players, and the trend is expected to grow as it becomes more mainstream. Given that the scene is still relatively young, there are lots of opportunities for traders to profit from the volatility.

DAY TRADING BASICS

While it is very easy to trade, there are a number of things you will need to think about before you get started so you can trade profitably. While some advertisements will promise you “get rich quick” type profits, there is a big difference between the novice trader and the professional. Some things we will cover below;

- Day Trading Overview

- What Equipment Do I Need?

- How Much Money Can You Make?

- How Can I Trade?

Day Trading Overview

- Day Trading is a term that technically refers to those traders who open and close their positions within the same day, rather than holding anything overnight. In practice however, there are a lot of different styles of traders, some who may focus on very short time-frames such as 1 minute and others who may take a trade over several days or even weeks if it makes sense to do so. The common feature however is the desire to cycle their capital relatively quickly so they can increase their holdings and look for the next trade. If you contrast this with more traditional investors whereby their practice is to ‘buy and hold’ and rebalance their portfolio every 6-12 months. Before taking the leap into trading it is obviously important to understand how to trade, but also how YOU will trade. As there is no right or wrong answer, it is important to identify a certain time frame or strategy that you will use consistently that fits with your personality and lifestyle. For instance, if you are trading in the 1-minute timeframe, then will need to be glued to your computer intensively while you are trading.

What Equipment Do I Need?

- After you have deposited funds in a crypto exchange such as FTX or Binance, the most obvious thing you will need to trade crypto is a good computer or laptop. After you’ve got the basics sorted, there are a number of other things which will make your journey easier. In order to track the fortunes of crypto projects and chart your strategy effectively, you will need a tool like TradingView. To enhance your experience further, a fast internet connection and a comfortable chair is also worth considering, while more advanced traders often use multiple screens so they can track the number of charts simultaneously. Other resources to help you can include joining various Telegram, YouTube and Twitter accounts to understand what is happening in the market and get different viewpoints.

Pour les douleurs courantes, les affections mineures ou les rhumes, beaucoup visitez cette se contentent de remèdes homéopathiques, de teintures et de sirops à base de plantes, voire de comprimés de paracétamol ou d’ibuprofène, pour lesquels aucune ordonnance n’est nécessaire.

How Much Money Can I Make?

- Now, the most common question is, “How much money can I make trading crypto?”. The answer can range from nothing to hundreds of thousands of dollars per year. The reason for such a huge variance comes down to several factors; 1) how much capital you have to start, 2) how skilled you are as a trader, 3) what strategy you use, and 4) how you manage your emotions. For those who are able to dedicate the time to learn the skills and understand what strategies are successful and not successful for them, then there is a higher likelihood of success. Thankfully there is a huge amount of information online related to trading crypto that is freely available on YouTube and courses that are on popular education platforms like Udemy. If you’d like something more professional you can check with your local education providers or stock exchanges who often have trading courses geared for stock trading. However, one thing to bear in mind is that many traders state that the mental game is one of the hardest factors to master as it is easy to become emotional when trading by letting losing trades run too long, and cutting winning trades short fearing they won’t go up any further. It is important to know yourself well and if you will be able to handle the significant swings in the market, or whether you are better off with another strategy such as ‘hodling’ (buy and hold) or letting a professional do it for you.

How Can I Trade?

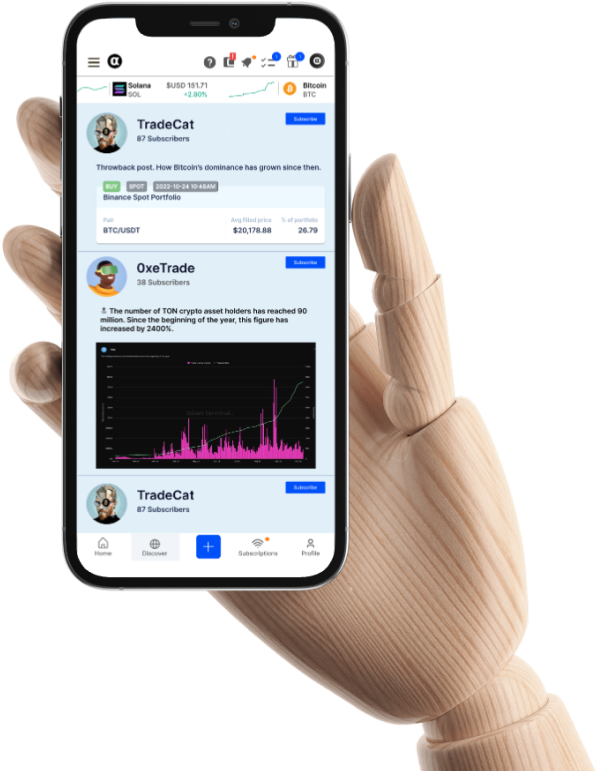

- If you’re keen to get involved in crypto trading, it is important to know ahead of time what amount of capital you can allocate without risking funds that will impact your daily life. One way to remove a lot of the time, stress, and research required for profitable trading is to copy-trade professionals. The Alpha Impact copy trading platform was built specifically for investors to leverage the skills of those who are trading crypto profitably and give retail investors access to their strategies automatically. Once you connect your exchange API to Alpha Impact, you are able to select a trader from various leaderboards and follow their trades automatically whilst not giving custody of the funds to Alpha Impact. Over time, you can use this method as a way to build up the confidence to trade by yourself or as a tool to enhance your existing trading methods.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok