eToro’s NASDAQ Debut: Copy Trading Platforms are a Billion-Dollar Opportunity

The world of investing and trading has transformed dramatically in the past two decades. One of the most innovative of these transformations has been the rise of copy trading platforms. These websites or apps allow investors to copy the trades of seasoned traders on the platform. eToro, a leading multi-asset investment and social (copy) trading platform, recently made the news by listing on the NASDAQ, proving yet again how copy trading platforms are a billion-dollar opportunity.

The News:

In May 2025, eToro disrupted the market by listing on the NASDAQ with an over 29% surge on debut. With the ticker ETOR and a whopping market capitalization of approximately $5.5 billion (based on launch-day trading), the public offering, which launched on the US-based exchange on May 14, 2025, with great market enthusiasm. It not only marked a momentous milestone for eToro but also highlighted the incredible market opportunity in the form of copy trading platforms.

As the demand for accessible, easy-to-follow investing tools rises among retail investors, copy trading platforms like eToro and Alpha Impact redefine how people invest in modern assets like cryptocurrencies.

eToro’s Journey: From Startup to Stock Exchange Listing

Founded in 2007 in Tel Aviv by Yoni Assia, Ronen Assia, and David Ring, eToro started with a web-based trading platform that combined learning and ease of use through a gamified investing experience.

The company came into the limelight in 2010 by introducing its flagship feature, Copy Trading, which allowed users to replicate the trades of successful investors on the platform. This allowed inexperienced retail traders to learn from and copy the success of existing traders.

Over the years, eToro introduced many features, including limited cryptocurrency trading in 2014, while eToro’s U.S. launch in 2019 played a crucial role in expanding its global appeal.

A Long Road to IPO

eToro’s path to the public launch was not easy. In 2021, it tried to go public via a SPAC merger. However, the deal fell through due to market volatility and regulatory delays. The company didn’t lose hope and kept growing its products and user base to finally, after 18 years of operation, go public, in May 2025, by launching its successful IPO.

The company sold 11.92 million shares at $52 each, raising over $620 million during the sale. With the company shares rising almost 30% on their first trading day, the overall stock valuation reached $5.5 billion, according to a Bloomberg report.

The Copy Trading Revolution

eToro’s success can be attributed to its easy to use Copy Trading features. But what makes copy trading such a compelling feature for retail investors?

Well, for one, it makes high-level investing accessible to everyone by reducing the need to learn, research, and manage assets. Copy trading platforms allow investors to replicate the success of seasoned investors by simply copying their trades.

Lately, copy trading has evolved into a more community-driven trading scenario, called social trading, which appeals to a generation infatuated with social media and engagement.

In 2024, eToro reported having around 3.5 million accounts, over 50% of which routinely engaged with the platform’s social features, which is a testament to the model’s outstanding popularity among traders.

Alpha Impact: The Next eToro?

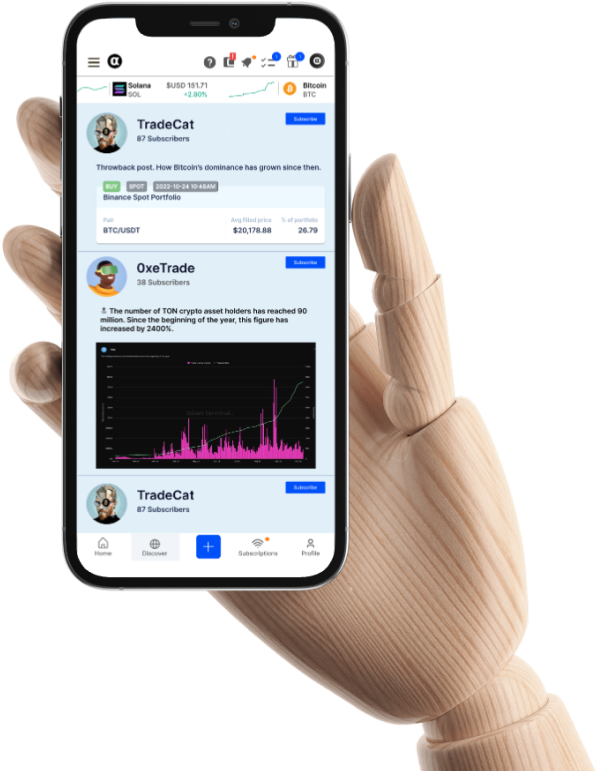

While eToro is already an IPO success story, newer trading platforms like Alpha Impact are ready to disrupt copy-trading with the adoption of agentic AI and on-chain trade signals. Founded in 2020, Alpha Impact provides copy trading and trade intelligence services for crypto markets, a niche that has become increasingly popular for its tremendous growth potential.

Alpha Impact allows users to view and copy real-time trades of seasoned crypto traders on its platform. Alpha Impact builds trust by offering complete transparency of every trade in real-time, comprehensive portfolio management with novel risk management features, enabling users to follow and copy real-world-signals.

Alpha Impact’s community-driven copy trading approach is particularly appealing to new crypto investors who may find digital asset trading too complex or volatile. By offering both learning opportunities and next-gen trade intelligence tools, Alpha Impact is creating its unique mark in the Web3 space.

Conclusion: The Billion-Dollar Opportunity

The outstanding success of eToro’s IPO will impact not just one company but the entire social and copy trading space, redefining it as a legitimate and high-reward investment opportunity that appeals to the modern investor who seeks accessibility and transparency driven by community goals.

As technology innovation continues forward, the next-generation of copy trading and trade intelligence platforms, led by companies like Alpha Impact, are ready to capitalize on the billion-dollar opportunity in copy trading.

Alpha Impact is fundraising. Contact [email protected] to learn more.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok