Creating Portfolio Transparency: Managing Portfolios That Work

With XRP and Solana being considered for ETFs and Meta embracing digital assets, crypto trading is becoming mainstream. But here’s what experienced traders know: success isn’t just about picking the right coins – it’s about having strategic portfolio management to help investors have better control over their investments.

This article explores how one can build a transparent and strategic crypto portfolio, with insights from Alpha Impact’s approach to complete trading transparency.

The Power of Portfolio Transparency

Having a clear and complete view of your investments means understanding:

- How are my assets actually performing?

- What is my risk exposure for each kind of cryptocurrency?

- Where are my opportunities and potential weak spots?

- How do market and regulatory changes affect my overall portfolio?

Key Elements of a Strategic Crypto Portfolio

1. Asset Diversification

A well-balanced crypto portfolio typically includes:

- Long-term: Bitcoin (BTC) and Ethereum (ETH) as foundation assets

- Growth Potential: Strategic positions in altcoins like Solana (SOL), BNB, or FOLO (Alpha Impact’s token) to ride market trends

- Safety Net: Stablecoins (USDT, USDC) for quick moves and increased liquidity

- Innovation: Calculated exposure to DeFi tokens and NFTs for high-growth opportunities

2. Active Risk Management

Success in crypto isn’t just about picking winners – it’s about protecting what you’ve earned. Understanding your risk tolerance creates the right balance between potential rewards and acceptable losses.

3. Regular Portfolio Rebalancing

One key part of having crypto portfolio transparency is regular portfolio adjustments, based on real-time market movements. This helps to maintain your target asset allocation and ensure that you stay aligned with your investment goals.

4. Liquidity Management

Having sufficient liquidity (liquid assets or cash) allows you to stay ready for opportunities without compromising long-term holdings.

5. Security and Custody

Using secure storage solutions for crypto assets, such as hardware wallets and reliable exchanges, is vital to reducing the risk of hacks and theft.

How Alpha Impact Enhances Strategic Portfolio Management?

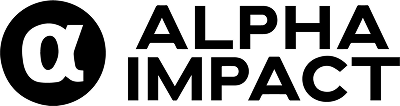

As a non-custodial crypto copy trading platform, Alpha Impact gives you the tools to build and manage strategic portfolios with clarity. The platform stands out for its advanced portfolio transparency and risk management features, which include:

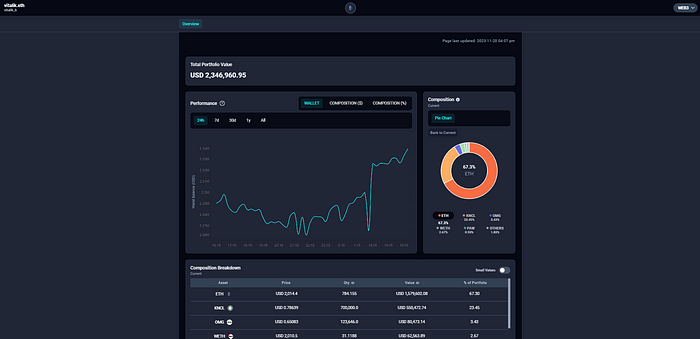

1. Deep Portfolio Metrics That Make Sense

Charts and numbers are great, but how many of us understand what they really mean?

Our dashboard cuts through the complexity to show you:

- Comprehensive trading performance metrics for all your investments

- Historical portfolio data to evaluate trading strategies

- Risk-adjusted return calculations with monthly Sharpe ratios

2. Multi-Portfolio Management, One Clear View

Perhaps you’re trading both long-term and short-term digital assets, or keen on exploring a range of trading strategies. At Alpha Impact, we make it simple:

- Manage multiple portfolios in one clear dashboard

- Compare strategy performance across market conditions

- Set customised risk management parameters to optimise capital allocation

3. Novel Hidden Stop Triggers for Risk Management

Here’s something most traders learn the hard way: regular stop-losses are pretty basic. They’re like having a security camera that everyone can see – not exactly ideal.

Our stop triggers offer capital protection beyond traditional stop-losses:

- Staying invisible to market makers and exchanges

- Having portfolio-wide balance monitoring, not just single trades

- Adapting to market conditions, such as using Bitcoin’s price movements

- Adjusting automatically to protect your gains

4. Copy Trading From Experts in Real-Time

Break traditional barriers with Alpha Impact’s cross-exchange copy trading. By featuring top traders from both Binance and Kucoin, users can:

- Learn from a wider variety of verified performers

- Access diverse trading styles and wider pairings

- Benefit from competitive pricing

Steps to Building a Transparent and Strategic Crypto Portfolio

Step 1: Set Investment Goals

Identify whether you’re aiming for quick profits, long-term growth, passive income, or high-risk rewards. This will help you with asset selection and risk management.

Step 2: Diversify Assets Strategically

Spread investments across multiple crypto assets ––such as major coins, altcoins, stablecoins, NFTs, and DeFi tokens–– to maximise potential whilst lowering risk.

Step 3: Leverage Advanced Tools for Insights

Leverage advanced portfolio management tools, such as those offered by Alpha Impact, monitor portfolio performance and make data-driven decisions.

Step 4: Implement Risk Controls

Set up smart stop-loss triggers that can safeguard your capital in the midst of unforeseen events.

Step 5: Rebalance Regularly

Regular portfolio review and rebalancing keeps your investment goals and strategy up-to-date with market conditions.

Conclusion

Remember: successful trading isn’t about catching every move – it’s about having full transparency and building a strategic crypto portfolio. Platforms like Alpha Impact offer cutting-edge trading solutions—such as deep portfolio analytics, multi-portfolio management, and smart risk management–– to empower investors at all levels.

By combining strategic portfolio management with the right tools, traders can manage their portfolios the right way and achieve long-term success.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok