Investing vs.Trading: What’s the Difference?

Investing and trading are two distinct approaches to profiting from the financial markets. In general, investors buy and hold assets to achieve higher returns over a longer period of time. Traders, on the other hand, use both rising and falling markets to enter and leave positions more quickly to gain smaller, more frequent profits. In this guide, we’ll break down what distinguishes investing and trading in more detail.

Investing

When you hear investing, think of long-term money-making. Investing is the process of purchasing and holding a portfolio of stocks, baskets of stocks, mutual funds, bonds, and other investment instruments with the purpose of building wealth over time. In fact, even those with a 401(k) or an IRA are investing. This means that, unlike traders, investors may not be checking the performance of their holdings each day.

To determine which stocks to invest in, investors will consider market fundamentals like price-to-earnings ratios and management prediction. Using these evaluations, investors will ride out downtrends. These stocks are often held for years or even decades so that you can earn interest, dividends, and stock splits. Compounding or reinvesting these profits and dividends into additional stock shares is a common way investors seek to increase their overall profits.

Trading

Focused on the opportunities of the day-to-day, traders typically engaged in more frequent transactions, always keeping an eye toward modest market mispricings on which to capitalize. These transactions will involve the buying and selling of stocks, commodities, or currency pairings. A trader’s goal is to outperform their buy-and-hold investment in terms of returns.

Unlike buy-and-hold investors, traders aim to make money quickly and may even employ techniques like short selling (selling at a higher price and buying to cover at a lower price to profit in falling markets) and using a protective stop-loss order (to shut off lost positions at a predetermined price level) to do so.

There are four main kinds of traders and each has a different style and asset holding style:

- Day Trader: Positions are held only throughout the trading day and no nighttime positions are held.

- Swing Trader: Positions are held for a period of time ranging from days to weeks.

- Position Trader: Positions are kept for a period of time ranging from months to years.

- Scalp Trader: Positions are held for seconds to minutes at a time, with no overnight holdings.

Alpha Impact

Here are a few smart tips that apply to both investors and traders:

Smart trading

- Make a buying and selling strategy and stick to it.

- Calculate how much you can afford to lose and never put in more than that.

- Make sure you understand your taxes, specifically short- and long-term capital gains.

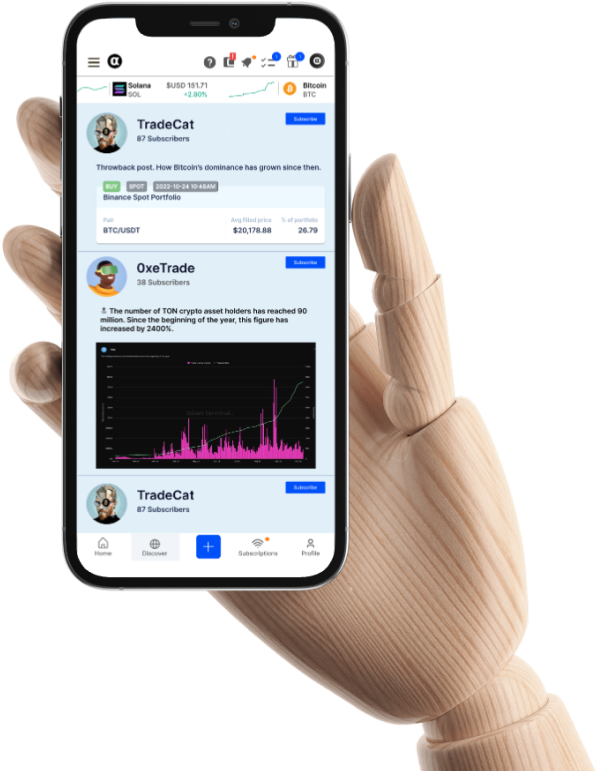

But nothing compares to learning from real people’s trading activity like you can on Alpha Impact’s social trading. Don’t miss out on the fun (and the funds) — join the Alpha Impact community today.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok