How Bitcoin Mark Price Helps You Control Volatility & Trade Smarter

As Bitcoin continues its rollercoaster journey in 2025, successful traders are realizing that smart risk management—rather than just bold bets—is the key to sustainable success. While newcomers often focus solely on entry points, experienced traders understand that managing positions using Bitcoin mark price and executing well-timed exits ultimately determine profitability.

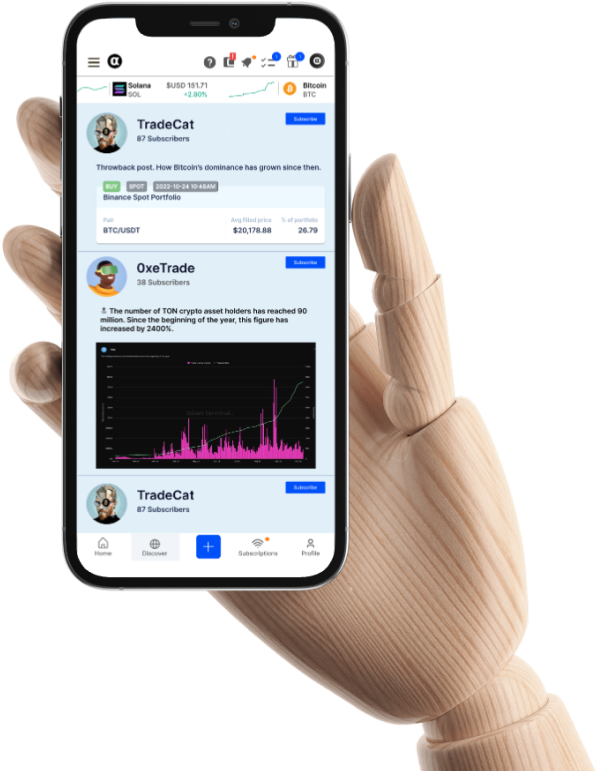

At Alpha Impact, we’ve built our platform to give you sophisticated risk management tools that leverage Bitcoin mark price to protect and grow your investments, even in turbulent market conditions.

Spot vs. Futures Trading

Think of crypto trading in two ways: getting the coins now, or making a deal for their future value.

- Spot Trading: The straightforward approach — buy Bitcoin (BTC) or Ethereum (ETH) directly, pay the current price, and immediately own the actual digital assets.

- Futures Trading: Instead of buying coins, you trade contracts whose value tracks the underlying crypto. Your profit or loss comes from price movements without owning the assets themselves

Futures contracts need reliable price benchmarks to function properly, which is why exchanges use reference prices: calculated values derived from multiple spot exchanges to ensure accuracy and prevent manipulation.

Understanding Reference Prices

At Alpha Impact, we enable traders to tie their take-profit and stop-loss orders to Bitcoin Mark Price or whole portfolio balances. Let’s dive into why this creates a better trading environment to participate in market growth, while managing downside risk.

Why Experienced Traders Prefer Bitcoin Mark Price

The Bitcoin mark price stands out as a beacon of stability in today’s fast-moving market. Unlike the last price, which can be swayed by temporary fluctuations, mark price offers a more holistic view of BTC’s true value by combining:

- Multiple index prices from leading exchanges

- Moving average benchmarks to smooth out short-term noise

- Current funding rates reflecting overall market sentiment

This creates a more dependable price reference that protects your trading positions when volatility strikes — which, as we’ve seen throughout 2024 and early 2025, remains a hallmark of crypto markets despite their maturation.

Note: The Mark Price is a theoretical value and not the actual value of what you buy or sell your crypto at. It’s what your platform uses to decide when to automatically close your trade — your liquidation price — and to show you your current, unrealised Profit/Loss (P&L)*.

*In futures trading, your unrealized P&L is simply the difference between your entry price and the current mark price.

How Top Traders Stay Ahead

The most successful traders understand that relying solely on last traded price leads to poor decisions during rapid market movements. They use mark price to gain three critical advantages:

✔ Reduced Risk of Market Manipulation: Mark price buffers against pump-and-dump schemes by averaging prices across exchanges, preventing unnecessary liquidations during artificial spikes.

✔ Improved Trade Reliability: When regulatory announcements hit, mark price smooths short-term volatility, helping you maintain your strategy rather than reacting to noise.

✔ Strategic Profit Lock-in: Rather than setting single take-profit targets, top traders place multiple orders at different mark price levels, systematically securing gains while maintaining upside exposure.

Smart Risk Management Strategies With Alpha Impact

At Alpha Impact, we’ve designed our platform to give you flexible options for managing risk.

You can set your Take Profit and Stop Loss orders based on either:

- Bitcoin Mark Price

- Your portfolio’s whole balance

- A combination of both

Here’s how top traders are using these features in today’s market:

Strategy 1: Cascading Take-Profit Orders

With many analysts like Tom Lee projecting BTC could reach $150,000 by year-end, a stepped approach to profit-taking makes sense. For example:

- Sell 15% when Bitcoin Mark Price hits $100,000 (major psychological barrier)

- Another 25% at $110,000 (secure substantial profits)

- Hold the remainder for potential further upside

This approach allows you to benefit from continued growth while protecting gains along the way.

Strategy 2: Bitcoin Mark Price Stop-Loss Protection

In a market where a single social media post can trigger significant price movements, having reliable exit points is essential. Mark price-based stop losses provide:

- Protection against flash crashes on individual exchanges

- Defense against short-squeeze attempts by market manipulators

- More reliable execution during high-volatility periods

Strategy 3: Hybrid Portfolio Management

Many successful traders on Alpha Impact employ strategies that leverage both approaches:

- Asymmetric risk management: Set stop-losses based on Bitcoin mark price (protecting against Bitcoin-led market crashes)

- Asset-specific allocation: Configure take-profits based on portfolio value (to capture upside across all holdings, be it major altcoins or minor cap holdings)

- Market conditions: Adjust reference mechanisms based on market conditions—portfolio balances during stable periods and mark price during high volatility

Finding Edge in Price Divergence

The growing gap between various market participants — from retail traders to institutional players — creates interesting dynamics between mark price and last price:

- When last price significantly exceeds mark price (often during retail FOMO phases), experienced traders recognise potential overbuying

- When last price falls below mark price (commonly seen during short-term liquidation cascades), it frequently signals buying opportunities before an inevitable rebound

These patterns have been particularly profitable throughout the ETF-driven bull market of 2024-2025.

Conclusion

The Bitcoin mark price represents one of the most valuable tools available to traders in today’s thriving crypto marketplace. As the market continues its expansion and maturation, the ability to distinguish between momentary price fluctuations and genuine market movements becomes increasingly valuable.

By tying your risk management with Alpha Impact, you position yourself to capitalise on the tremendous opportunities in the current market while protecting your capital during inevitable periods of volatility. This balanced approach allows you to participate confidently in one of the most exciting financial markets of our time.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok