Manual vs. Automated Crypto Trade Signals: Which One is Right for You?

In the whirlwind world of cryptocurrency trading, information is power. That’s where crypto trade signals come into play – think of them as your personal trading compass in the choppy waters of digital asset markets.

Alpha Impact has emerged as a leading platform in this space, offering traders comprehensive tools to leverage both manual and automated crypto trade signals.

Understanding Crypto Trade Signals

At their core, crypto trade signals are strategic recommendations that guide traders on when to buy or sell. These aren’t just random suggestions, but carefully crafted insights derived from technical analysis, market conditions, and performance data.

The cryptocurrency signal market ranges from free basic insights to premium, in-depth analysis. While free signals can help beginners, professional traders typically invest in more comprehensive services.

The most valuable crypto trade signals go beyond simple buy/sell recommendations. They dive deep into:

- Market sentiment analysis: Tracking social media trends, news, and expert recommendations to understand market psychology

- On-chain analytics: Analysing blockchain transactions and crypto wallet movements to gain market knowledge

- Risk management signals: Providing real-time alerts for stop-loss (SL) and take-profit (TP) strategies based on market shifts

- Portfolio performance tracking: Live updates on portfolio performance and strategic insights

Key Takeaway: An effective trade signal is a multi-layered, intelligently constructed recommendation that goes far beyond simple trading advice.

The Human Touch: Manual Trade Signals

Manual signals are recommendations generated by experienced traders who actively analyse market conditions. These experts use their deep market knowledge to identify potential trading opportunities that go beyond pure data points.

Pros of Manual Trade Signals:

✅ Expertise Beyond Numbers: Experienced traders interpret complex market dynamics, catching subtle trends algorithms might miss

✅ Flexible Adjustments: Quick pivots during breaking news or unexpected market shifts

✅ Transparency & Learning Opportunities: New traders gain insights into strategic thinking and market analysis techniques

These signals are often shared directly with new traders through social media or dedicated trading communities, where verified traders help newbies by sharing their valuable insights and strategies.

Cons of Manual Trade Signals:

❌ Time-intensive market tracking

❌ Potential for emotional bias

❌ Slower trade execution compared to automated systems

The Machine Approach: Automated Crypto Trade Signals

Powered by artificial intelligence and machine learning, automated signals generate and execute trades based on sophisticated algorithms and historical market data.

Pros of Automated Trade Signals:

✅ Lightning-Fast Execution: Process market data and execute trades in milliseconds, taking advantage of brief market opportunities

✅ Emotion-Free Trading: Strict adherence to predefined rules without falling prey to fear or greed

✅ Scalability: Track multiple cryptocurrencies simultaneously and manage complex trading strategies across different markets

Cons of Automated Trade Signals:

❌ Limited human intuition

❌ Over-reliance on historical data

❌ Potential technical failures or system glitches

The Role of Copy Trading in Crypto Trade Signals

Trading signals serve as a strategic learning tool for traders at all experience levels. Novice traders can potentially generate profits while gaining market insights, while experienced traders can explore new opportunities and refine their strategies.

Manual crypto trade signals cater to hands-on learners who want to analyse market conditions deeply, while automated signals appeal to traders seeking fast, emotion-free execution. Most advanced traders don’t choose between these approaches — they combine them.

Alpha Impact’s Multi-Trade Execution Platform

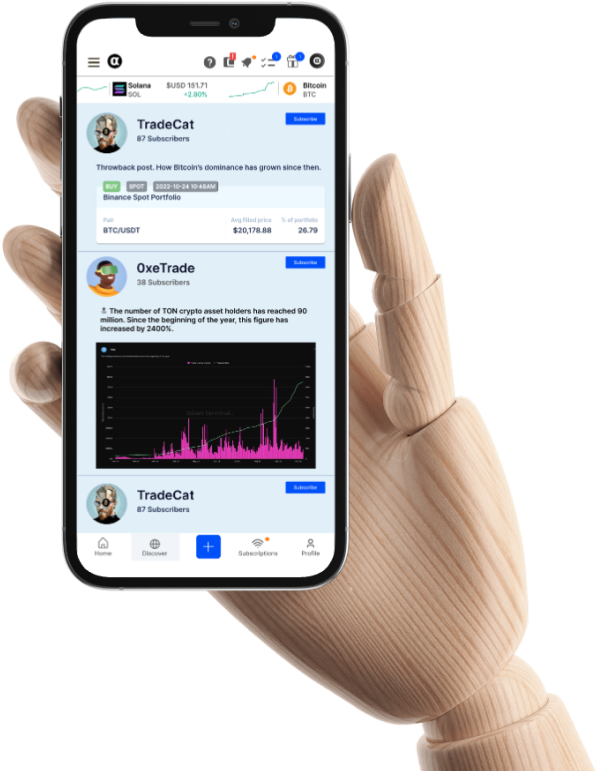

Alpha Impact offers a multi-trade execution platform that combines manual and automated crypto trade signals through copy trading. Users can automatically replicate expert trades while maintaining access to risk management tools and portfolio tracking for informed decision-making.

- Transparency: Users gain visibility into traders’ real-time activities and performance history

- Trader Integrity: Trader opinions are blockchain-verified with proof-of-trade and proof-of-word

- Risk Control: Users can customise their stop-loss triggers by tying them to whole portfolio balances or external market events, like Bitcoin Mark Price

- Cross-Exchange Trade Execution: Users can auto-copy trade signals across Binance and Kucoin to diversify strategy and access better coin pairings

Final Thoughts

Both manual and automated signals have value in cryptocurrency trading –– the best approach depends on your experience, time, and trading goals! Many traders succeed by combining methods on platforms like Alpha Impact that offer transparency and multi-trade execution.

Ready to elevate your trading? Sign up with Alpha Impact to leverage expert trade signals and advanced risk management.

Note: Alpha Impact is working towards an on-chain platform, which will bring even greater transparency and verifiability to our community.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok