Maximise Profit From Crypto Trade Signals During Market Volatility

In the fast-moving crypto world, market volatility is both a challenge and an opportunity. Recent news about tariffs impacting global markets, PayPal expanding support for Solana, ADA’s inclusion in multiple ETFs, and RLUSD integrating with Ripple payments have created waves of volatility. For savvy traders, these conditions offer prime profit potential – if you know how to use crypto trade signals effectively.

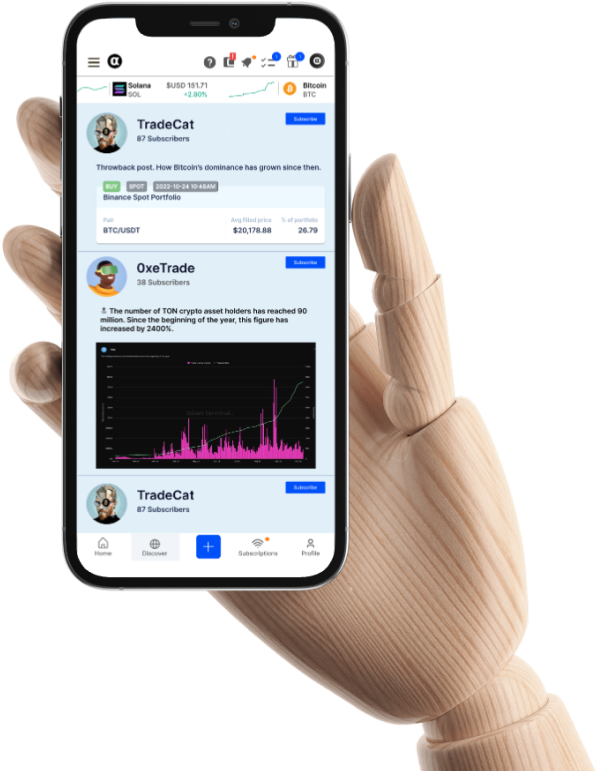

Platforms like Alpha Impact provide access to real-time trade signals and insights from experts, allowing users to learn from and copy successful traders and use advanced risk management tools to make the most out of their trading activities.

Note: Alpha Impact working towards an on-chain platform, which will bring even greater transparency and verifiability to our community.

Understanding Crypto Trade Signals

A trade signal is an alert, insight, or recommendation that advises users to buy, sell, or hold specific assets based on market conditions. Traditionally, trade signals were based on fundamental analysis and technical indicators. However, modern crypto trade signals offer a more comprehensive approach by incorporating:

✅ On-chain analytics – Monitoring large blockchain transactions, wallet movements, and activity

✅ Market sentiment analysis – Analysing social media trends, news, and expert views

✅ AI-powered predictive models – Analysing historical performance data to predict future price trends

✅ Risk management alerts – Protect your market positions with real-time alerts on stop-loss (SL) and take-profit (TP) strategies set by traders

Traders can utilise these modern crypto trade signals to make more informed decisions and remain profitable even in volatile market conditions.

Turning Volatility Into Opportunity with Crypto Trade Signals

Many traders fear volatility, but with the right crypto trade signals, market turbulence becomes your ally. Sharp price drops create buying opportunities, while rapid upswings offer chances to take profits.

The key strategies include:

- Using signals to spot cryptocurrencies poised for recovery or breakout

- Implementing short-term trades based on intra-day movements

- Setting strategic stop-loss orders to limit downside risk

Platforms like Alpha Impact provide these essential crypto trade signals alongside robust risk management tools, making volatile conditions more navigable.

How to Profit from Crypto Trade Signals on Alpha Impact

1. Leverage Copy Trading to Replicate Profitable Trades

Why struggle alone when you can follow expert traders? Copy trading lets you automatically replicate the moves of successful traders who are already interpreting crypto trade signals effectively.

Example: When a seasoned trader opens a position based on their analysis of market signals, their action is mirrored in your portfolio – giving you access to their expertise without years of learning curve.

2. Optimise Entry and Exit Points with Take-Profit (TP) & Stop-Loss (SL)

Volatile markets demand precise entry and exit strategies. Effective use of crypto trade signals means combining timely alerts with

- Take-profit (TP) settings that lock in gains at predetermined price points

- Stop-loss (SL) orders that limit potential losses if the market moves against you

With Alpha Impact, you can even set multiple TP/SL levels based on either your overall portfolio balance or to external market events like Bitcoin (BTC) Mark Price, allowing greater flexibility and control over risk and reward.

3. Diversify Across Multiple Exchanges

Smart traders don’t limit themselves to a single exchange. One major advantage of Alpha Impact is its ability to allow traders to use crypto trade signals more effectively to make profitable trades on Binance and KuCoin, among other crypto exchanges.

Other benefits include:

- Access more trading pairs and deeper liquidity

- Find price discrepancies between exchanges

- Execute based on crypto trade signals wherever the best opportunity exists

This multi-exchange approach maximises your ability to act on crypto trade signals effectively, regardless of where the opportunity appears.

4. Follow Market Sentiment and Social Trading Insights

Numbers alone don’t tell the full story. Community sentiment often drives crypto movements, making social trading insights invaluable supplements to technical crypto trade signals. By monitoring:

✅ Community opinions on specific cryptocurrencies

✅ Portfolio updates and real-time trade activity from successful traders

✅ Discussions in dedicated trading communities

You gain contextual awareness that helps validate or question the crypto trade signals you receive.

Conclusion: Maximise Your Profits with Smart Crypto Trade Signals in a Volatile Crypto Market

While market volatility continues, particularly with global economic factors in play, these conditions provide prime opportunities for traders using quality crypto trade signals.

Alpha Impact offers a multi-trade execution platform that combines manual and automated crypto trade signals through copy trading. Users can automatically replicate expert trades while maintaining access to risk management tools and portfolio tracking for informed decision-making.

- Transparency: Users gain visibility into traders’ real-time activities and performance history

- Trader Integrity: Trader opinions are blockchain-verified with proof-of-trade and proof-of-word

- Risk Control: Users can customise their stop-loss triggers by tying them to whole portfolio balances or external market events, like Bitcoin Mark Price

- Cross-Exchange Trade Execution: Users can auto-copy trade signals across Binance and Kucoin to diversify strategy and access better coin pairings

Start using crypto trade signals strategically, and you’ll find yourself viewing market volatility not as something to fear, but as your greatest profit opportunity.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok