Why Risk Management Matters: A Guide To Alpha Impact’s TP/SL Tools

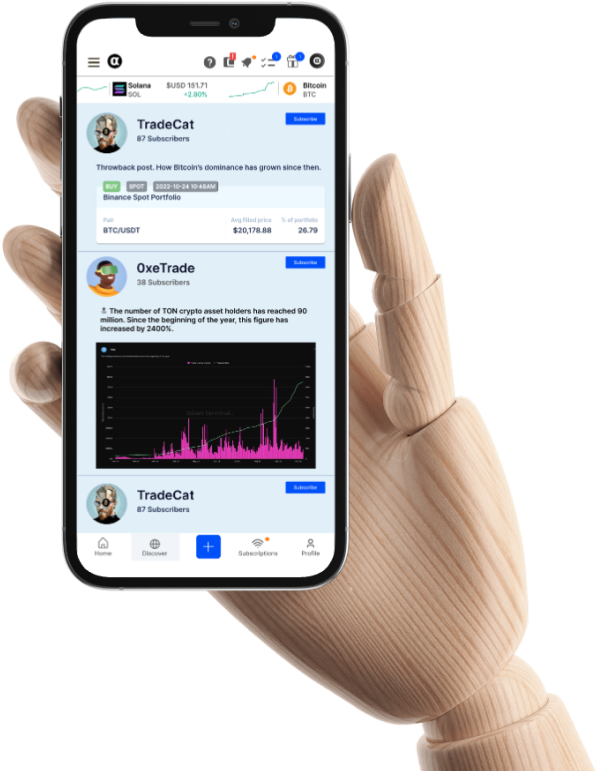

Risk management in crypto trading doesn’t have to be complicated. Alpha Impact makes it simple with novel Take-Profit (TP) and Stop-Loss (SL) features that help protect your investments and lock in gains. Here’s how to use these tools effectively.

Why Risk Management Matters: A Real-World Example

Ethereum’s recent price action demonstrates both the importance of risk management and the opportunities that market volatility creates. Just hours away from Sunday’s downtrend, BTC is already currently trading near $98,500 – up 3.48% and ETH is trading at $2,710 – up 4.90% in the past 24 hours.

This market movement offers valuable lessons:

- Smart traders with stop-losses protected their capital during the initial drop

- Those using take-profit orders captured gains during price rebounds

- Experienced traders are watching key support levels for potential entry points

- Portfolio protection tools helped minimize exposure to sudden market shifts

Common risks in crypto trading include:

Market Volatility: Cryptocurrencies are prone to unforeseen price fluctuations that can result in unexpected losses.

Emotional Trading: Emotions like fear and greed often result in traders making poor decisions.

Lack of Automation: Missing the right opportunities due to inattention.

To minimise these risks, traders can use risk management options such as Take-Profit (TP) and Stop-Loss (SL) to automate selling at predefined price points.

What are TP/SL Orders?

Take-Profit (TP) and Stop-Loss (SL) are two of the most popular tools for crypto traders to manage risks:

- Take-profit (TP): Sets a sell order that executes automatically when your asset reaches your target price, securing your profits before any trend reversal

- Stop-loss (SL): Automatically sells your asset if the price drops below your set level, protecting you from further losses

By using TP/SL orders, traders can ensure their desired trades are automatically executed, taking emotions out of the equation and mitigating risks. Alpha Impact offers advanced risk management tools such as TP/SL to optimise trade execution.

Alpha Impact’s Advanced Risk Management Features

Alpha Impact’s TP/SL system provides traders with more control, flexibility, and protection when managing their portfolios. Here are some of its outstanding features:

1. Multiple Trigger Options

Alpha Impact offers two different ways to execute TP/SL orders:

- Portfolio-level protection: Set orders based on your total portfolio value. This is useful when you want to protect overall account value, and helps maintain consistent risk levels across all trades.

- External market events: Orders are executed based on external market factors like Bitcoin (BTC) Mark Price. This helps protect against broader market movements.

2. One-Cancels-Other (OCO) Protection

When one order triggers (either TP or SL), the other automatically cancels, preventing conflicting trades and ensuring smooth portfolio management.

3. Hidden TP/SL Orders for Security

Unlike other platforms, Alpha Impact keeps your TP/SL levels private. This means other traders can’t see where you’ve set your exits, protecting you from market manipulation.

Risk Management With TP/SL Orders on Alpha Impact

Setting up TP/SL levels on the Alpha Impact platform is simple and involves just a few easy steps:

- Go to Your Linked Portfolio on the Alpha Impact platform.

- Click “Edit” on the trade you want to edit or change.

- Input Your TP and SL Levels. These are price levels at which you want the system to execute sell orders automatically. Select either portfolio-based or BTC mark price triggers.

- Click “Save” to confirm changes.

You can modify these levels anytime before the conditions to trigger are met, providing you the flexibility to adapt based on market conditions.

Smart Ways To Use TP/SL Levels on Alpha Impact

To make the most of Alpha Impact’s risk management features, here are some expert practices for managing TP/SL Levels:

For Take-Profit Orders:

- Set realistic profit targets based on evolving market conditions

- Experiment placing multiple TP orders to lock in gains gradually, such as using both portfolio-based and BTC mark price triggers

- Look at key resistance levels when setting TP prices

For Stop-Loss Orders:

Using Ethereum’s recent movement as an example:

- Place stops below key support ($2,200-$2,600 range for ETH)

- Give your trades enough room to breathe during volatility

- Consider your risk tolerance – most traders risk 1-2% per trade

Other General Tips:

- Follow the 1:3 Rule: Risk $1 to make $3

- Frequently monitor market news and macro trends, and adjust stops accordingly

- Review levels daily and move to breakeven after gains

Getting Started

Start small with a test trade to get comfortable with the system. Remember: good trades come from good risk management, not just good entry points. As Ethereum’s recent volatility showed, proper TP/SL orders can protect your capital from significant losses.

Bottom Line

Alpha Impact combines social trading with robust risk management tools. Whether you’re new to crypto or an experienced trader, features like community-driven trading, full transparency, and non-custodial security help you trade more effectively while managing risks.

Ready to protect your trades?

Log in to Alpha Impact and set up your first TP/SL orders today.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok