What Is The Bitcoin Halving?

If you’ve started to learn about bitcoin, you may have seen articles or YouTube influencers make reference to the term “bitcoin halving” (or “halvening”). Often it comes up when pundits are discussing the price or potential price movements for bitcoin, yet it is not often explained in much detail.

Bitcoin is produced by the work of bitcoin ‘miners’ who solve complex mathematical problems using computing power. In return for solving these equations, the miner is rewarded with a set amount of bitcoin for each ‘block’. Over time, the reward that the miners receive is automatically reduced by 50% by the bitcoin protocol and these events in supply reduction are referred to as the “halving”.

BITCOIN HALVING BASICS

In the following points, we will break down some of the key concepts which relate to the bitcoin halving / halvening;

- Bitcoin Mining Overview

- When Is The Next Halving?

- What Does It Mean For Me?

Bitcoin Mining

- Bitcoin has an economic model which deliberately halves the reward that miners receive after every 210,000 blocks are mined. As of now, bitcoin miners receive 6.25 coins per block and this will reduce to 3.125 coins per block after the next halving event in 2024. This fixed reduction in supply will occur until all 21 million bitcoins have been mined sometime around 2140. So why does this occur? In layman’s terms, it is built into the bitcoins code to ensure that bitcoin is deflationary (eg; the purchasing power goes up). In other words, as the coins will get more scarce over time, they should become more valuable. If you compare this to traditional fiat currency, governments often print more money and the long-term value of the currency is eroded as things like housing, education, and general goods become more and more expensive over time creating wealth gaps in society.

When Is The Next Halving?

- Due to the way in which the bitcoin mining process works, it is difficult to know precisely when the next halving will take place. The reason for this is that the computing power that is allocated to mining is constantly changing, but it is expected to be approximately between April and June 2024. For a live update, you can check here . After the 2024 halving, there will only be two more halvings after this (around 2028 and 2032) with over 99% of bitcoin expected to be mined by 2032.

What Does It Mean For Me?

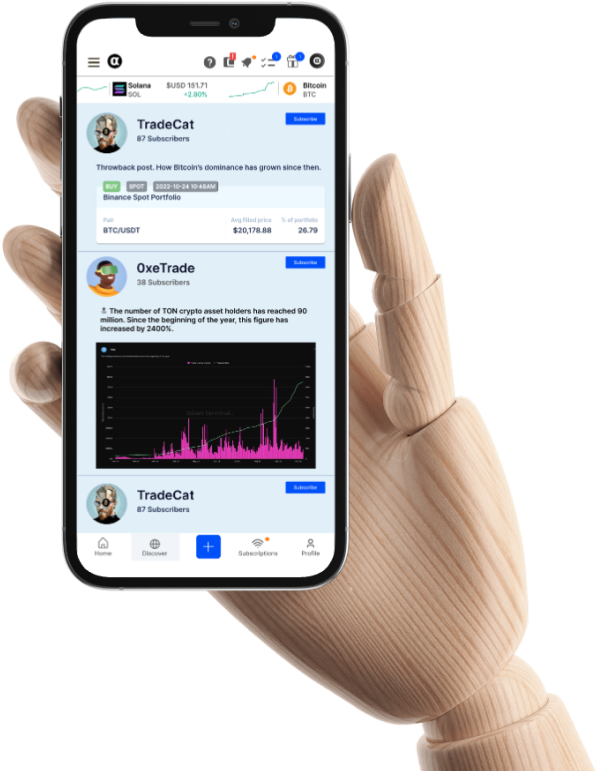

- So, what does this mean for your average bitcoin investor? At a high level, it is good to understand how the mechanics of the protocol work, yet you can also benefit from understanding the cycle if you are a long-term investor or trader. One popular model created by a Twitter user with the handle “PlanB” illustrates the projected rise (and fall) in bitcoins price based on the distance to the halving dates. In general terms, his “Stock to Flow” model shows a significant rise in bitcoins price for the next 12-18 months after the halving events and a low approximately 15 months before the halving, so both of these can potentially provide a long-term trade signal (eg; buy and sell 15 months before/after halvings ). Likewise, it shows that the price will fall during a certain period preceding a halving. Of course, if all of this is a bit too complicated or you aren’t enthralled by watching the bitcoin calendar, then copy-trading a professional trader at Alpha Impact can generate your returns on the way up and down based on the halving cycles.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok