What Is A Bull And Bear Market?

You often hear people mention the term “bull and bear” or you might have heard someone proclaim that they are “bullish” or “bearish” when talking about an individual asset or the markets as a whole. What do the terms mean and how should you position yourself in each? You may also wonder; how does this relate to crypto?

No matter what asset class you are referring to, the term “bull market” and “ bear market” refer to the prevailing trend at the time. For a market or asset, to be defined technically as “bullish”, it should have risen 20% or more from the previous low. Likewise, for something to be defined as “bearish”, it would have seen a decline of more than 20% from the high. In the traditional markets, the average bear market loss has been -35% while the average bull market gain is 104%.

OVERVIEW OF BULL AND BEAR MARKETS

While there isn’t a common view on how the terms “bull” and “bear” came to pass, the most widely accepted story is that the way in which both creatures attack their opponents is similar to market movements. In this version, bulls thrust upwards, while bears swipe their attackers down. Regardless of where the terminology came from, it’s useful to get a basic understanding of their relationship in crypto per our points below;

- Overview

- Crypto Bull Markets

- Crypto Bear Markets

- Tactics

Overview

- As crypto markets aren’t as large as the traditional stock market, they are a lot more volatile meaning that you could witness extreme price movements that are sustained over several days. This type of activity is not as common in the stock market and it is also important to note that even in a bull market, you can witness bearish movements in individual projects, without meaning that something has flipped bullish to bearish. It is only sustained bearish activity which would then change the overall sentiment (and vice versa when a bearish market shows signs of bullish momentum).

Crypto Bull Markets

- Much has been written about the power of a crypto bull markets with huge fortunes being created off relatively small investments using leverage or even spot buys. Indeed, these stories are what has drawn in a lot of retail investment and “FOMO” (Fear of missing out) driving the prices even higher. As Bitcoin was only invented in 2009, the cryptocurrency market doesn’t have the longevity of traditional markets, but even in this short time there has been a number of bull markets. Due to the programmable nature of the bitcoin protocol and the in-built deflationary mechanism of the “halving”, the bull markets have been every four years; 2013, 2017 and now in 2021. Of course, nothing is guaranteed, but it is expected that the next bull market will occur in 2025.

Crypto Bear Markets

- As sure as night follows the day, the bear markets follow the bull market and punish bullish investors in a brutal destruction of value. The most famous bear market to date was the most recent one starting in early 2018 due to the number of retail investors who jumped in at the peak of the bull market in late 2017. The sheer mania which existed in the market in time particularly relating to ICOs (Initial Coin Offerings) was destined to end badly and did so, falling a spectacular 80%. Previous bear markets were mostly confined to early believers in the space and had less impact on retail and institutions, but were also bloody affairs with approximately 80-90% of the market cap being wiped.

Tactics

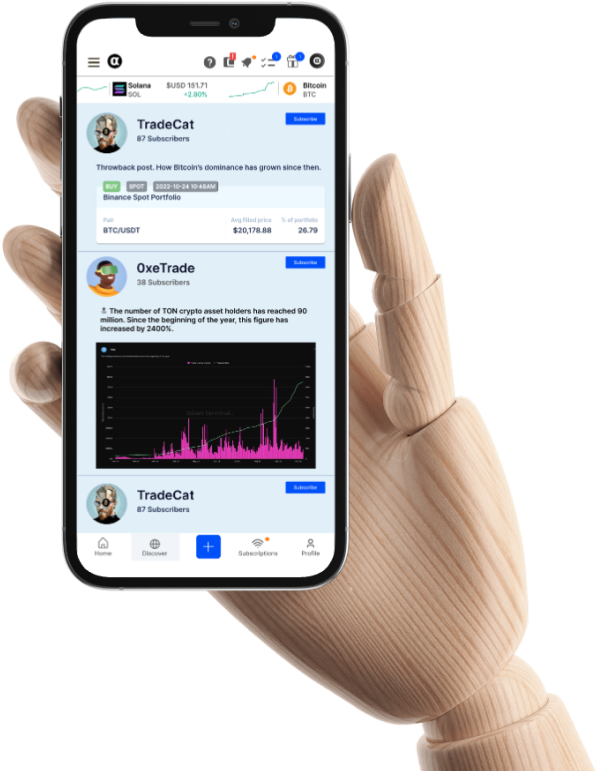

- As an investor, how can you capture the gains of a bull market while minimizing losses during a bear market? There is a famous saying in trading which says, “Bulls make money, Bears make money, Pigs get slaughtered” which effectively means that you can make money in either direction, but not if you’re greedy. So, rather than limiting yourself to black-and-white thinking that a bear market is “bad” and a bull market is “good”, you can learn strategies to make the most of volatility in either direction. It is worth noting however that a bear market does require more skill to realize consistent profits and some traders specialize in these environments. If you don’t feel comfortable trading by yourself, or would like additional upside no matter the market conditions, then you can consider following professional traders on Alpha Impact and automatically copying their crypto trades after linking your exchange. Alpha Impact is never in custody of your assets and you are in complete control over who you copy-trade with so you can rest easy regardless of whether the bulls or bears are in charge of the market.

About Alpha Impact

Alpha Impact is a non-custodial, technology platform building social infrastructure and integrates with Interoperable Real-World Signals.

Our Interoperable platform provides real-time trade signals, comprehensive cross-exchange portfolio analytics, risk management, and copy trading. This empowers signal providers to monetise their expertise and actionable insights through a social community.

App | Website | Whitepaper | Telegram | Telegram ANN | Medium | Twitter | Facebook | LinkedIn | Github | Instagram | Youtube | Tiktok